Euro (EUR/USD) Latest Analysis and Charts

- EUR/USD rises for a third straight day

- Corporate earnings have boosted overall risk appetite

- US labor stats are firmly in focus

The Euro was higher against the United States Dollar on Friday with market risk appetite sending the latter broadly lower.

Apple’s second-quarter earnings generally pleased, or relieved, the crowds after their release on Thursday. They beat expectations across various metrics and added a blockbuster, $110 billion share buyback. It wasn’t all good news by any means, however. The tech giant fretted a challenging demand environment, particularly in China, but equity investors were disposed to focus on the positives.

French banks have added to the cheer on Friday, with strong reports from Credit Agricole and Societe Generale.

While the Euro has benefitted from a generally more upbeat market risk tone, it’s hard to see the current rally lasting given that prospects for the European Central Bank’s monetary policy seem to diverge markedly from those for the Federal Reserve.

The ECB is expected to fire the starting gun on rate reductions next month, while the market is now starting to doubt whether we’ll see any similar action from the Fed at all this year given the enduring spring in the US economy’s step. The Euro held gains on Friday despite news of a surprise fall in French industrial production which only underlines the contrasting fortuned of the Eurozone and US.

The next major trading cue for EUR/ USD and, of course, most other markets, will be the release of key US labor market statistics later on Friday. Expectations center around a 243,000 April rise in nonfarm payrolls and a steady overall unemployment rate of 3.8%. A stronger release will cast more doubt on the prospect of US rate cuts this year and may see EUR/USD gains fizzle.

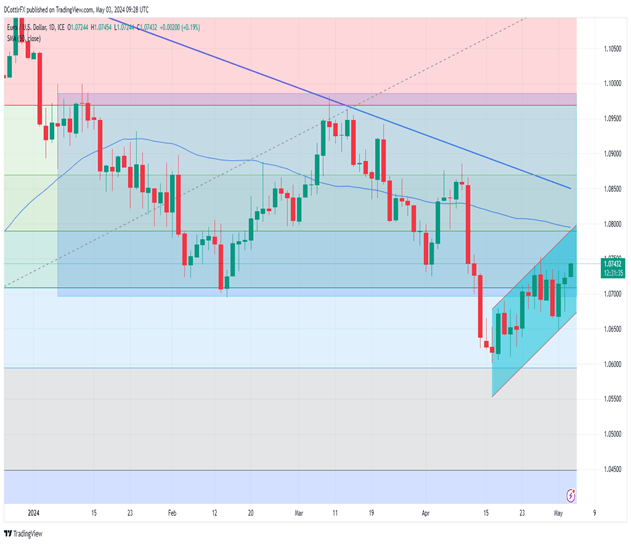

EUR/USD Technical Analysis

EUR/USD’s uptrend from mid-May has seen the pair edge back into the broad trading band that contained trade between early January and mid-April. That now offers support at February 14’s low of 1.06950 and retracement support at 1.07205.

Bulls will face resistance at the 50-day moving average which comes in at 1.07916, with 1.08815 and 1.08534 waiting above that. The latter level is derived from the downtrend line from the peak of December 28.

IG’s own sentiment index suggests that EUR/USD’s near-term path is uncertain, with a narrow majority of 53% bearish at current levels. However, despite two weeks of steady gains, the pair’s Relative Strength Index shows it by no means overbought, suggesting that the path higher remains open if risk appetite holds up.

| Change in | Longs | Shorts | OI |

| Daily | -1% | -4% | -3% |

| Weekly | 4% | -10% | -5% |