US Dollar Slumps After NFPs Miss Expectations, US Equities Bid

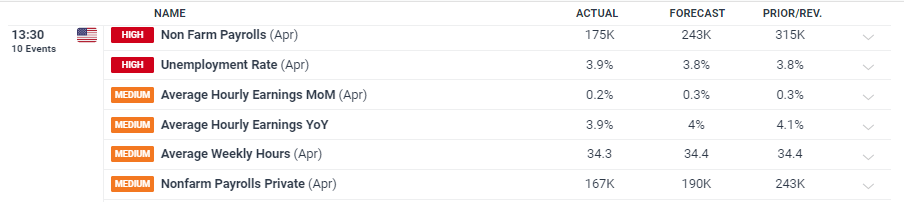

- US NFPs print at 175k vs. forecasts of 243k.

- US dollar slumps as rate cut expectations improve.

For all economic data releases and events see the Monarch Capital Institute

The latest US Jobs Report showed hiring slowed in April with just 175k new jobs added compared to forecasts of 243k and an upwardly revised 315k in March (from 303k). Average hourly earnings y/y fell by two-tenths of a percentage point to 3.9%, while the unemployment rate ticked 0.1% higher to 3.9%.

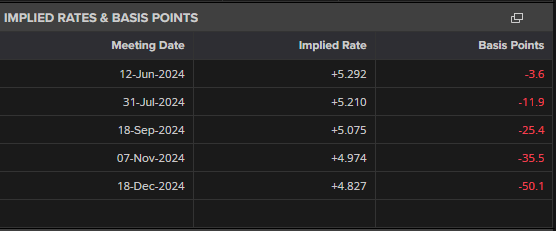

Today’s release pushed market expectations of rate cuts higher, with the latest probabilities showing around 50 basis points of rate cuts this year. At the start of the week, this figure was around 28 basis points. According to market forecasts, a September rate cut is now fully priced in.

Learn how to trade data and news events with our free, expert guide.

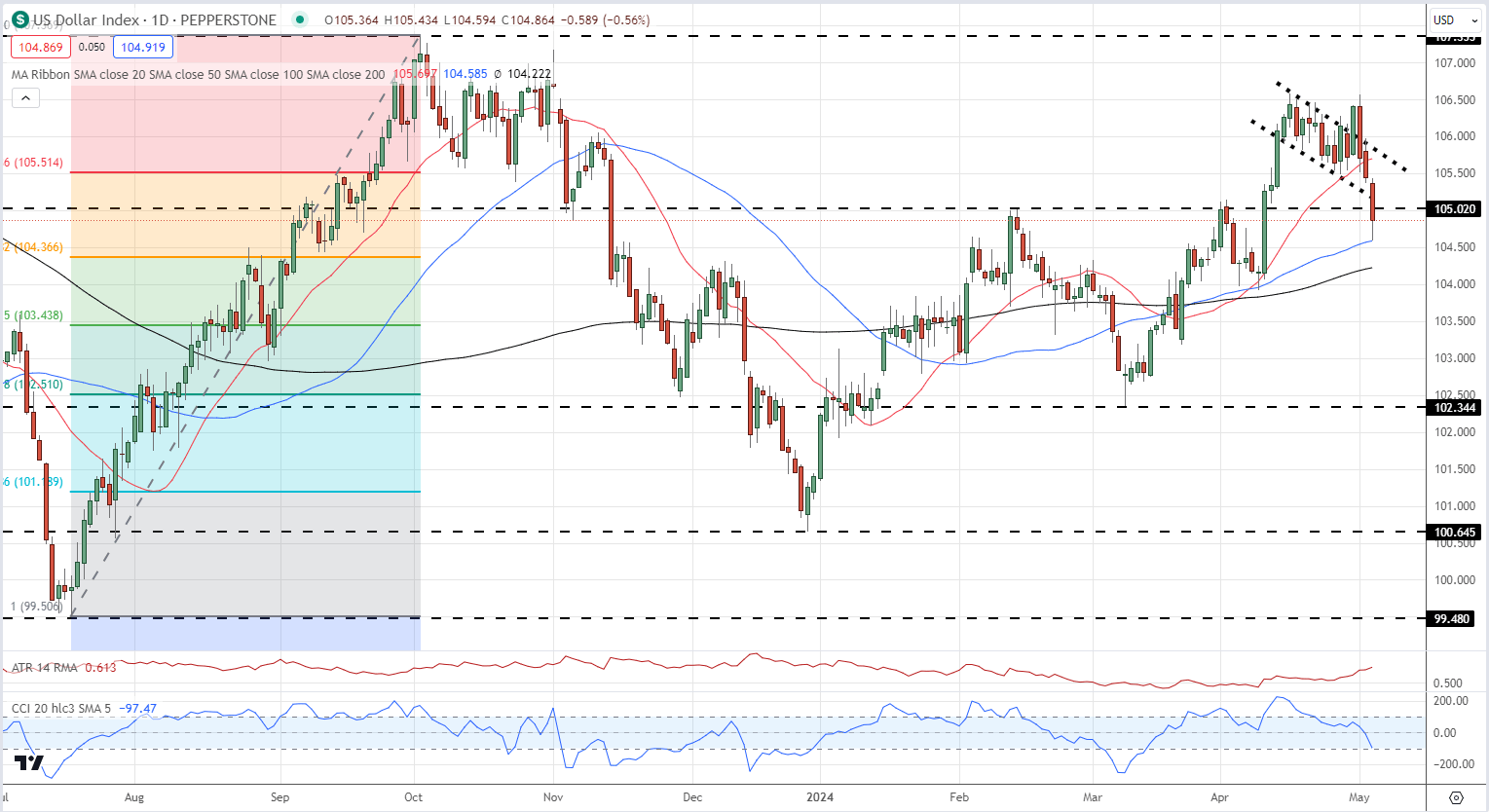

The US dollar fell sharply post-NFP release with the dollar index breaking through the 105.00 level with ease. The next level of support, the 38.2% Fibonacci retracement level, is seen at 104.38.

US Dollar Index Daily Chart

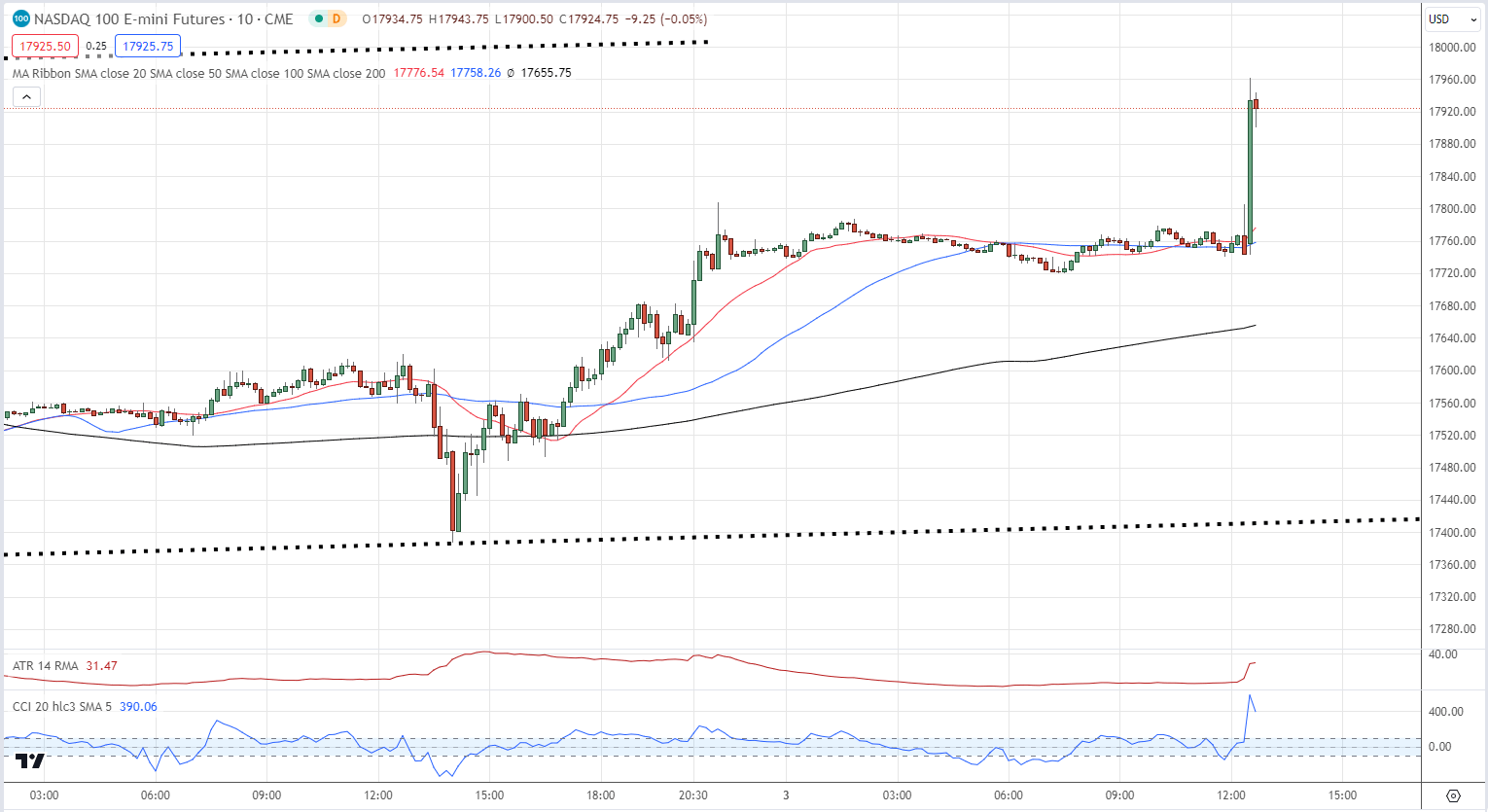

US indices pushed higher after the Jobs Report with Nasdaq futures adding 200 points before drifting a touch lower…

Nasdaq Futures 10 Minute Chart

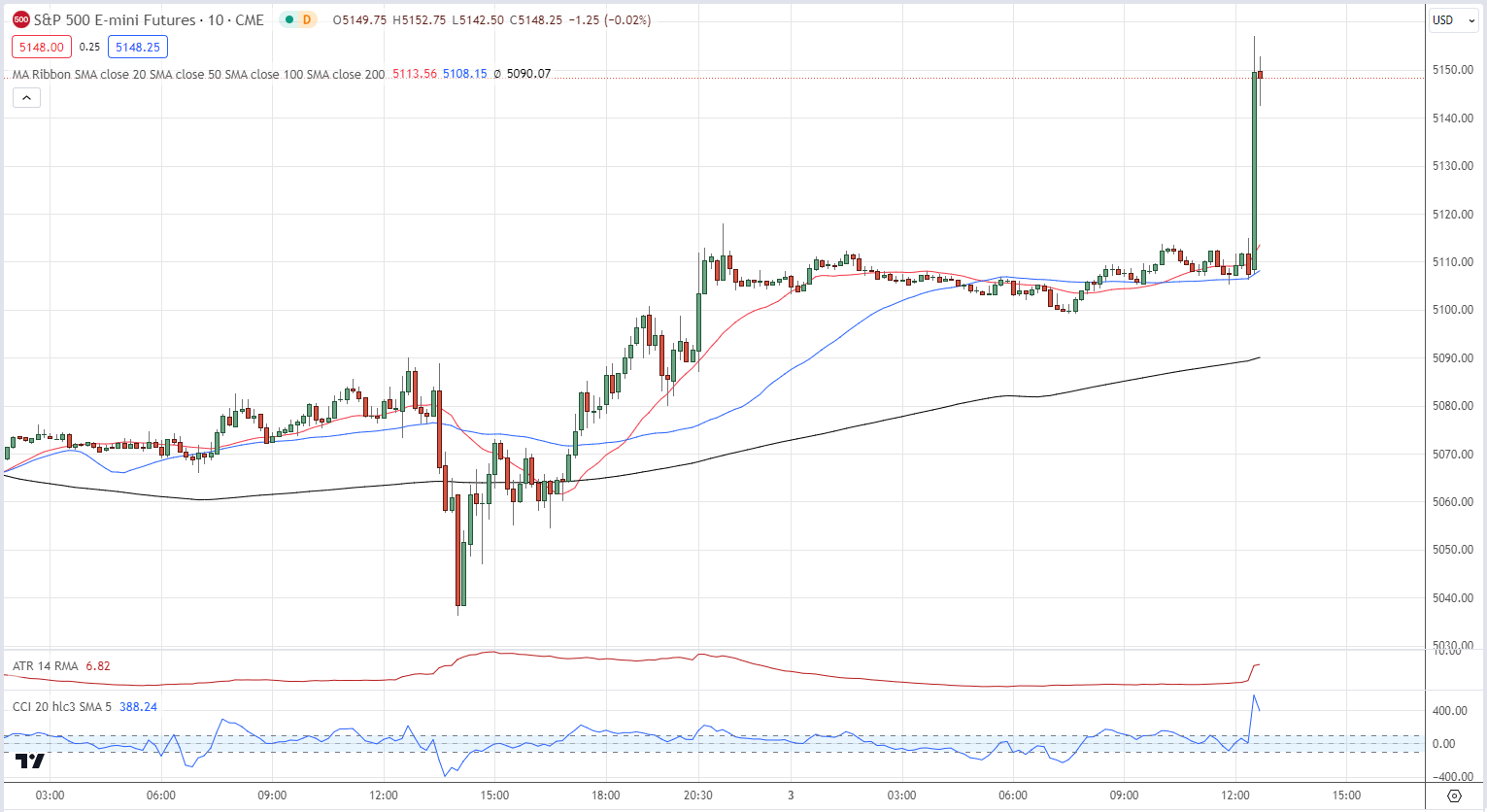

…while the S&P futures added just over 40 points.

S&P 500 Futures 10 Minute Chart

| Change in | Longs | Shorts | OI |

| Daily | 1% | -1% | 0% |

| Weekly | 15% | -13% | -1% |