Japanese Yen Prices , Charts, and Analysis

- Bank of Japan warns over Yen weakness.

- US dollar strength may force further intervention.

The Bank of Japan will closely monitor the FX market as USD/JPY pops back above 155.00, despite two rounds of ‘official’ intervention. Recent commentary by BoJ chief Kazuo Ueda suggests that the central bank are ready to act again, especially if a weak Yen starts to raise prices of imported goods. Speaking in Parliament on Wednesday, BoJ chief Ueda said, ‘Foreign exchange rates make a significant impact on the economy and inflation…depending on these moves, a monetary policy response might be needed’. The Bank of Japan is thought to have intervened twice last week in the FX market, buying Yen and selling US dollars. Although no official data is currently available, it is thought that the central bank intervened to the overall tune of around Yen9 trillion or around $60 billion.

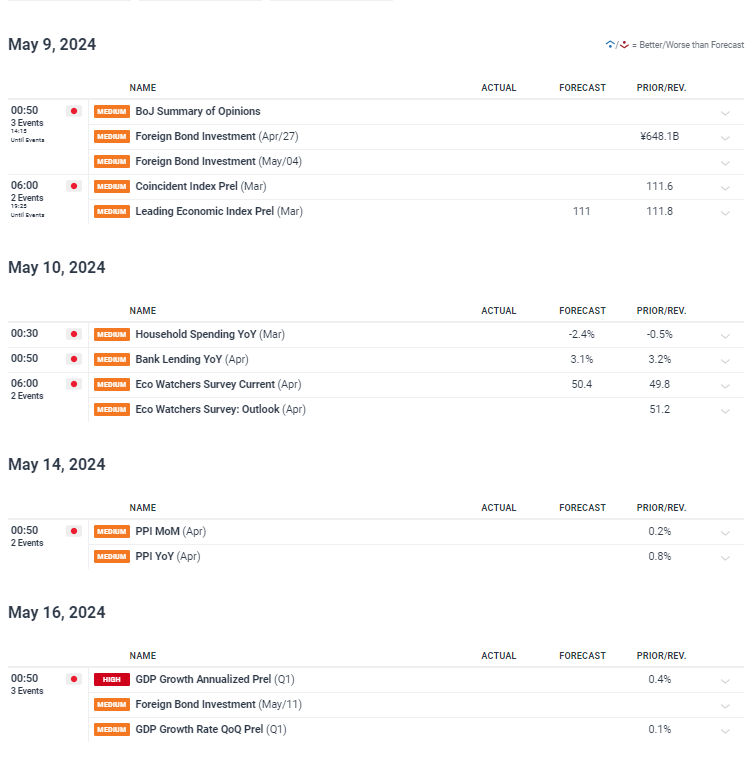

The Japanese economic data and events calendar has a few releases worth watching over the coming days, including the BoJ Summary of Opinions, before the Q1 GDP figure hits the screens on May 16th.

For all market-moving global economic data releases and events, see the Monarch Capital Institute

The latest move higher in USD /JPY is negating the recent efforts by the Japanese central bank to boost the value of the Yen. Japanese officials will soon need to decide if the 155 level is an appropriate rate for USD/JPY in the short term. This is unlikely, given the recent central bank commentary, and it is likely that the BoJ/MoF will shortly return to the market in a further effort to boost the Yen. Official commentary will no longer work and the central bank will now have to decide how aggressive they can afford to be, and if they can get co-ordinated help from other central banks, to get the Yen to a level they feel appropriate. Central banks have deep pockets but markets can be ruthless and they will test any hesitation or wavering by the BoJ. The next few weeks look set to be volatile.

Learn How to Trade USD/JPY with our expert guide:

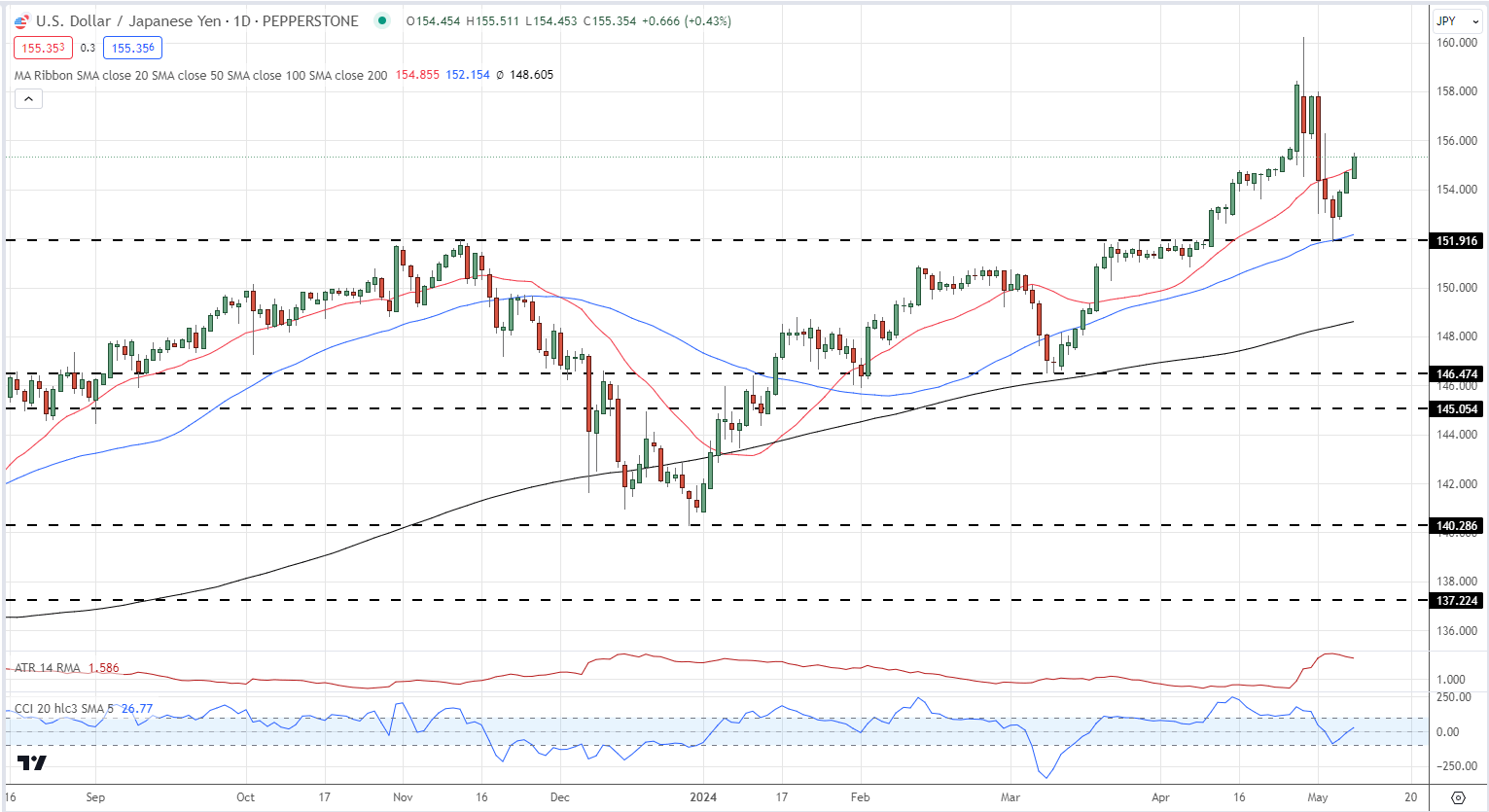

USD/JPY Daily Price Chart

Retail trader data show 32.23% of traders are net-long with the ratio of traders short to long at 2.10 to 1.The number of traders net-long is 3.94% lower than yesterday and 26.12% higher from last week, while the number of traders net-short is 4.69% higher than yesterday and 24.31% lower from last week .

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/JPY prices may continue to rise.

| Change in | Longs | Shorts | OI |

| Daily | -2% | 2% | 0% |

| Weekly | 12% | -16% | -6% |