GBP/USD and FTSE100 Analysis and Charts

- UK economy ‘going gangbusters’ – Office for National Statistics.

- Sterling underpinned, FTSE 100 continues to print record highs.

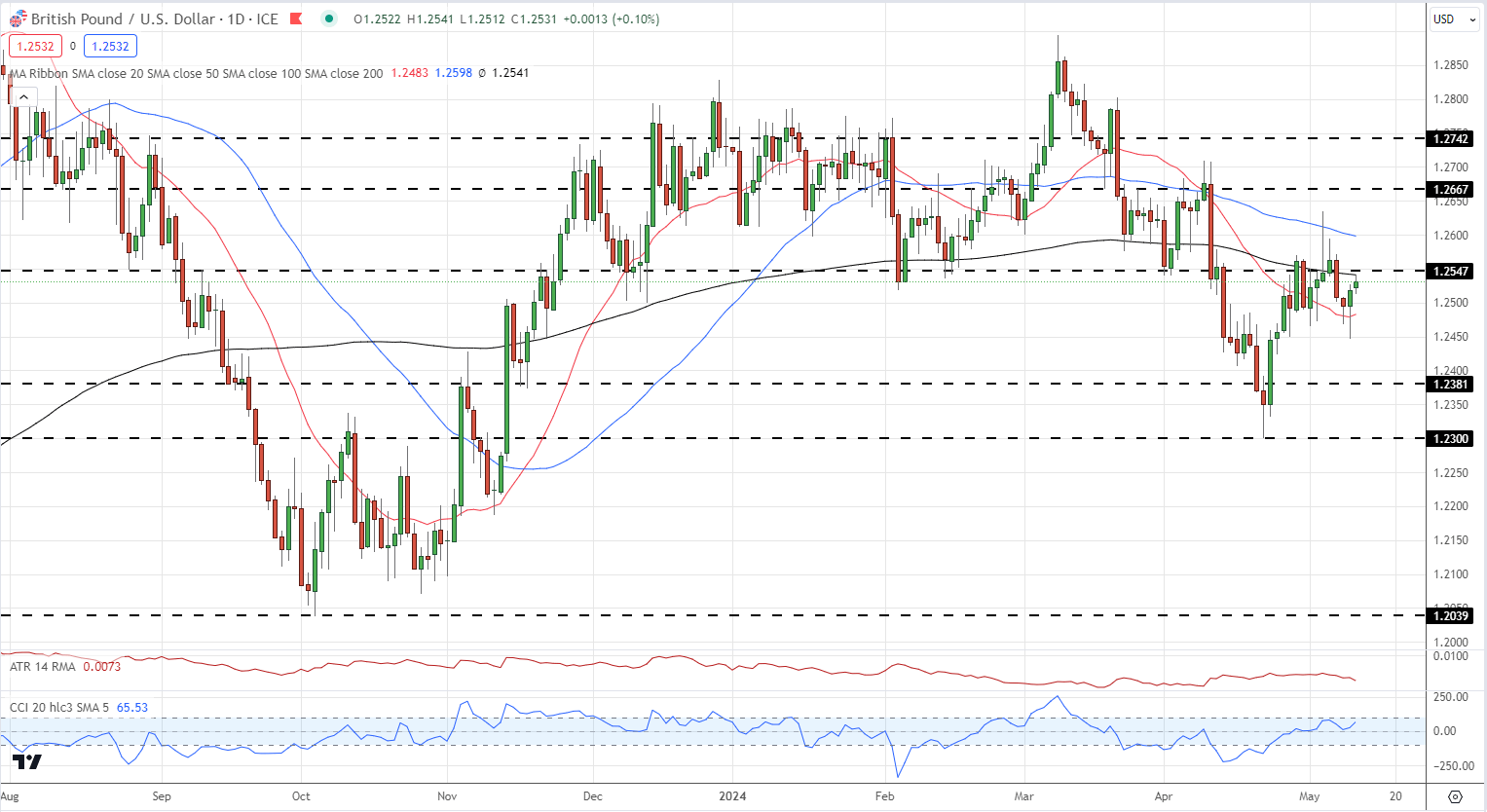

The UK economy grew by 0.6% in the first quarter of the year, driven by a 0.7% increase in services output, beating analysts’ forecasts and ending the technical recession seen last year. Nominal GDP is estimated to have grown by 1.2% in Q1. According to ONS chief economist Grant Fitzner, ‘ to paraphrase the former Australian Prime Minister Paul Keating, you could say the economy is going gangbusters.’

Full ONS Q1 GDP Report

For all market-moving economic data and events, see the Monarch Capital Institute

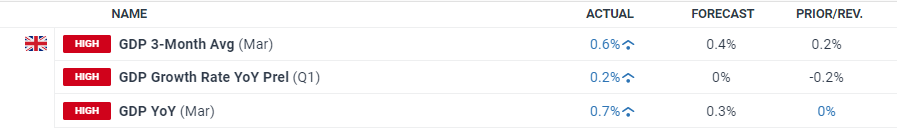

Interest rate cut expectations were pared back marginally post-data. The first 25 basis point BoE cut is seen in August, although the June meeting remains a live event, with the second cut forecast for November.

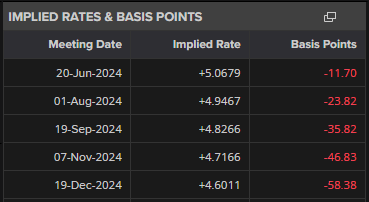

Cable ( GBP/USD ) moved slightly higher after the data release, helped in part by a weak US dollar . The 200-day simple moving average (1.2541) is now blocking a further higher and unless US data out later today weakens the greenback further, short-term cable upside may be limited.

GBP/USD Daily Price Chart

IG Retail data shows 57.48% of traders are net-long with the ratio of traders long to short at 1.35 to 1.The number of traders net-long is 9.60% lower than yesterday and 19.72% higher than last week, while the number of traders net-short is 2.23% higher than yesterday and 13.42% lower than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP / USD prices may continue to fall.

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |

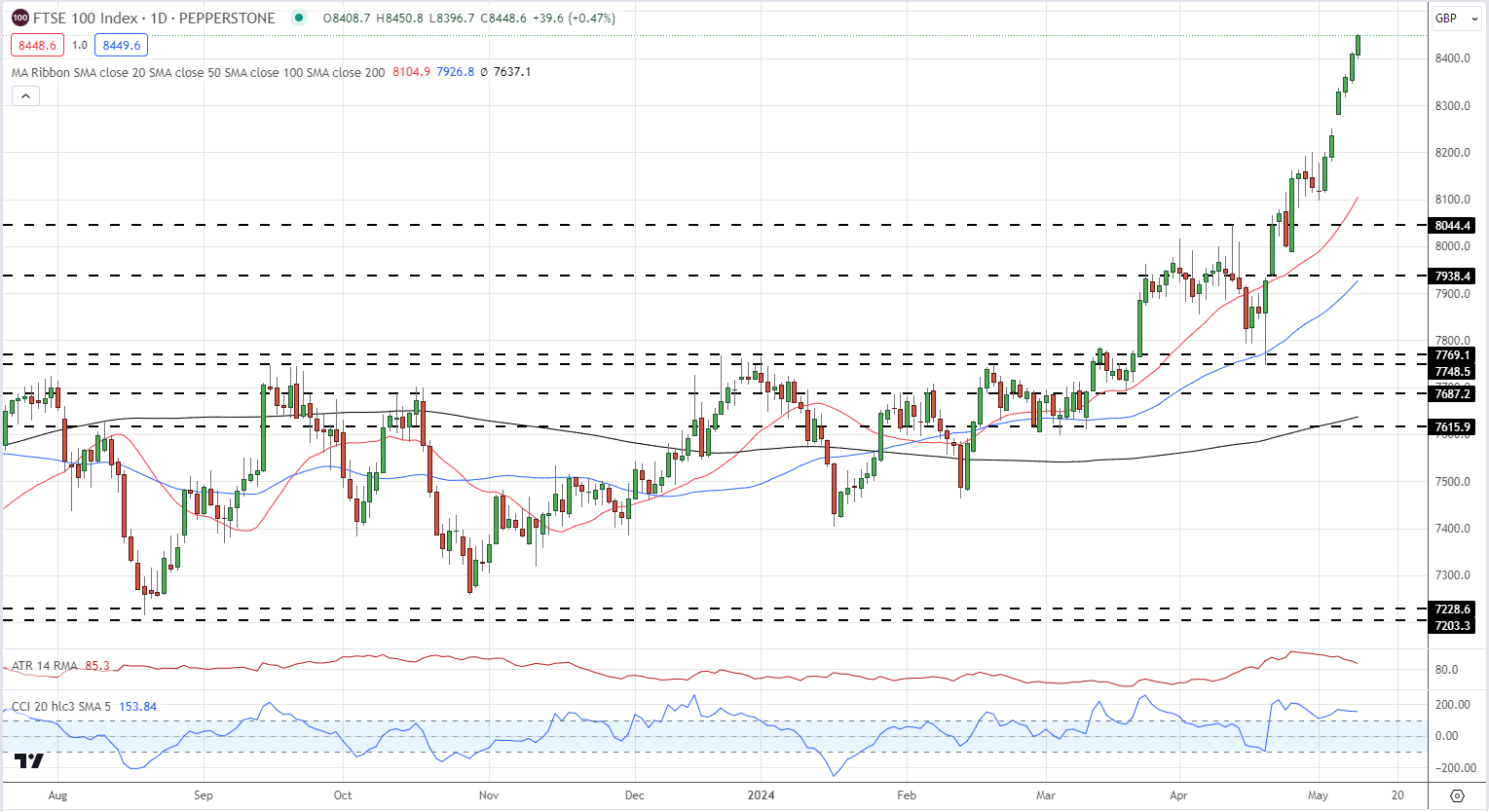

The FTSE 100 continues to post fresh all-time highs, with today’s GDP data sending the UK big board through the 8,400 barrier. The ongoing re-rating of the FTSE 100, and increased M&A activity has seen the index surge by around 1,000 points off this year’s low. Six green candles in a row underscore this week’s rally. Going into the weekend, the index may slow, but with UK economic confidence growing further, the outlook remains positive.

FTSE Daily Price Chart