Pound Sterling (GBP/USD) Talking Points

- GBP/USD holds above $1.25

- However, its 200-day moving average still caps the market

- It will be interesting to see if it still does at the end of this week

- Get your hands on the British pound Q2 outlook today for exclusive insights into key market catalysts that should be on every trader's radar:

The British Pound made gains against the United States Dollar on Monday, but the currency remains within an established trading band before the week’s major scheduled trading events, most of which will come from the US.

The Bank of England’s May monetary policy meeting has come and gone. Interest rates weren’t altered, but markets were left with the impression that a reduction in June remains on the table even if an August move is more likely.

The prospect of the BoE moving before the Federal Reserve ought perhaps to have weakened Sterling more than it has.

After all, futures markets don’t see US borrowing costs coming down before September. Moreover, judged by recent, hawkish commentary from the Fed’s rate setters, even that might be optimistic. Governor Michelle Bowman said last Friday that she doesn’t think it will be appropriate for the Fed to cut interest rates at all this year. Of course she doesn’t speak for all, but it seems certain that the rate-cut faction will have a debate on its hands to get its way.

So why is the Pound still relatively buoyant? Well, for one thing expectations for both central banks remain heavily dependent on data we haven’t seen yet, and inflation remains above target on both sides of the Atlantic. Expectations can change quickly and traders know it.

For another, the UK economy has done better than many thought it might at the start of this year, with the most recent growth data beating expectations and pointing to a much shallower and shorter recession earlier this year than the norm, With London’s blue-chip stock index at record highs, the country is benefitting from a revival in market risk appetite.

This week’s main UK trading cue will probably come on Tuesday with the release of official labor-market statistics for March. Markets will pay particular attention to earnings growth, with the Pound likely to catch a bid if that rises above the 5.3% rate expected.

However, Fed Chair Jerome Powell is scheduled to speak on Tuesday too, ahead of the next batch of UK inflation numbers. GBP/ USD is unlikely to move far before the market has seen those.

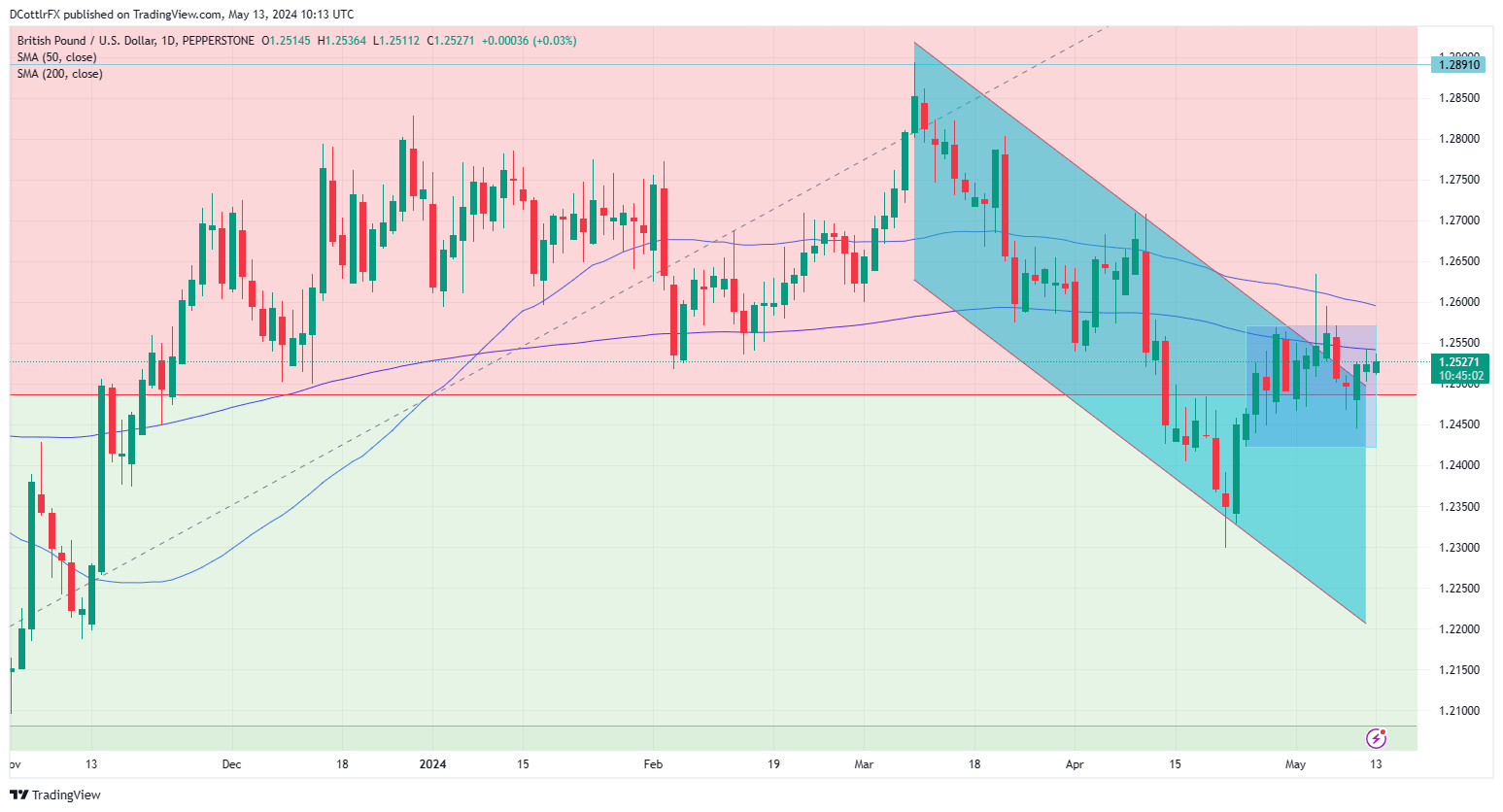

GBPUSD Technical Analysis

The Pound remains within the clear, sideways range which has taken it out of the previously dominant downward channel.

Sterling bulls retain the upper hand, it seems, but they’re probably going to have to force the pace above GBP/USD’s 200-day Moving Average soon or some doubts will probably set in. The MA hovers just above the market at £1.2504 and, while that should be well within range, the market struggles to close above it.

Support at the first retracement of the rise up to mid-July’s highs from the lows of September 2022 still looks important. It comes in at 1.24874.

Retail trade data show market participants quite evenly split on GBP/USD’s prospects from here, with the bulls clinging to a small majority.

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |