Major Indices Talking Points

- Dow reaches fresh new high

- Nasdaq 100 surges to new peak

- Nikkei continues to make gains

- Discover the main considerations when trading major indices in Q2:

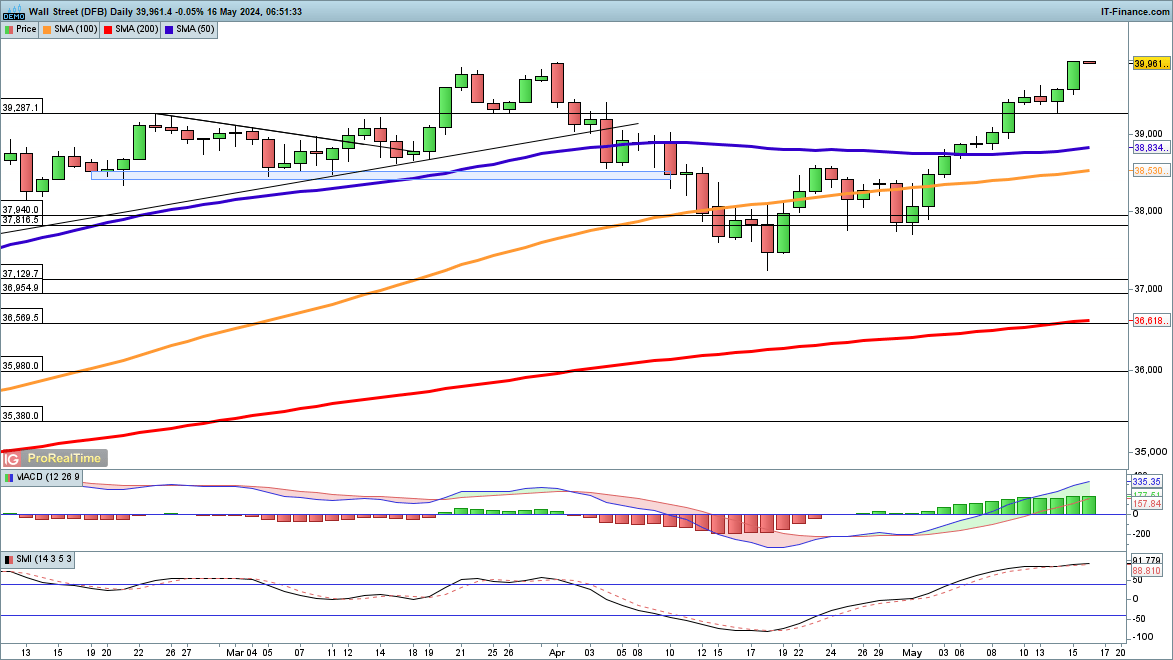

Dow at new high

The index touched a new record high yesterday, faltering just shy of the 40,000 level.

Yesterday’s US inflation print provided the catalyst for a fresh surge, which allowed the index to build on the gains made over the past month since the lows of April. Expectations of two Fed rate cuts have been revived now that US inflation is showing signs of slowing once more.

Further gains will quickly take the index above the psychological 40,000 mark, and then from there new record highs come into view. Short-term weakness would likely require a close back below the previous highs around 39,287.

Dow Jones Daily Chart

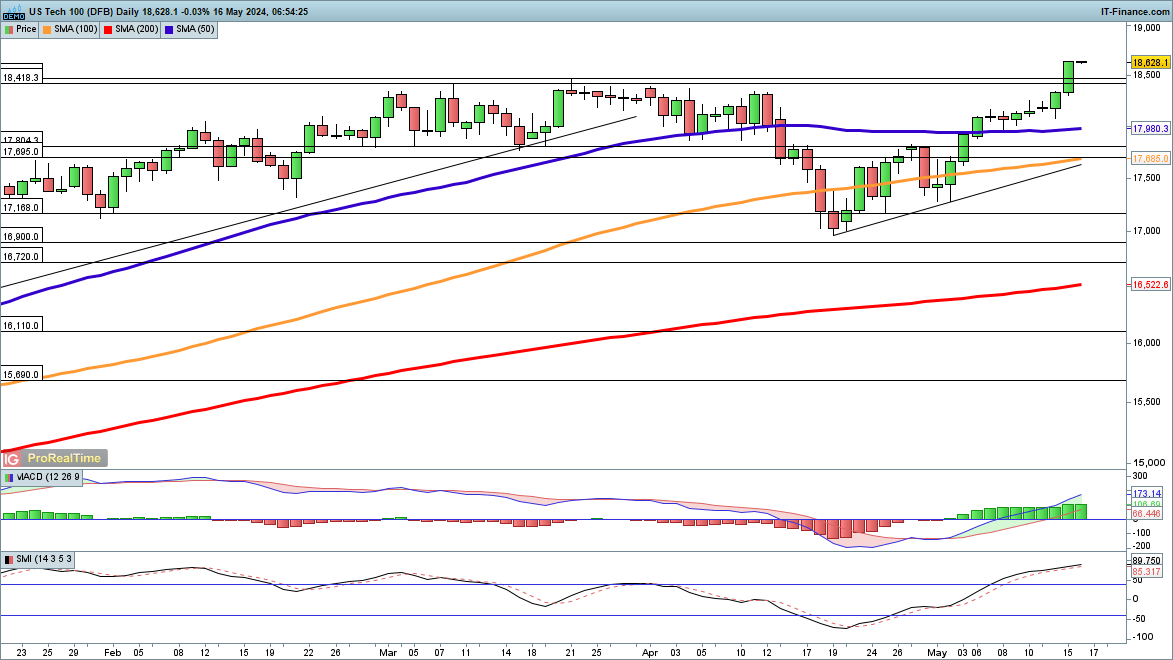

Nasdaq 100 shoots to new peak

This index also witnessed a surge on Wednesday following the inflation data, and this carried the price to a new record high, smashing through the 21 March record high of 18,466.

From here the 19,000 level comes into play, as fresh flows drive the price higher. Having established a higher low in mid-April, the index remains firmly in an uptrend.

Short-term weakness would need a close back below 18,200, which suggest at least some consolidation is likely.

Nasdaq 100 Daily Chart

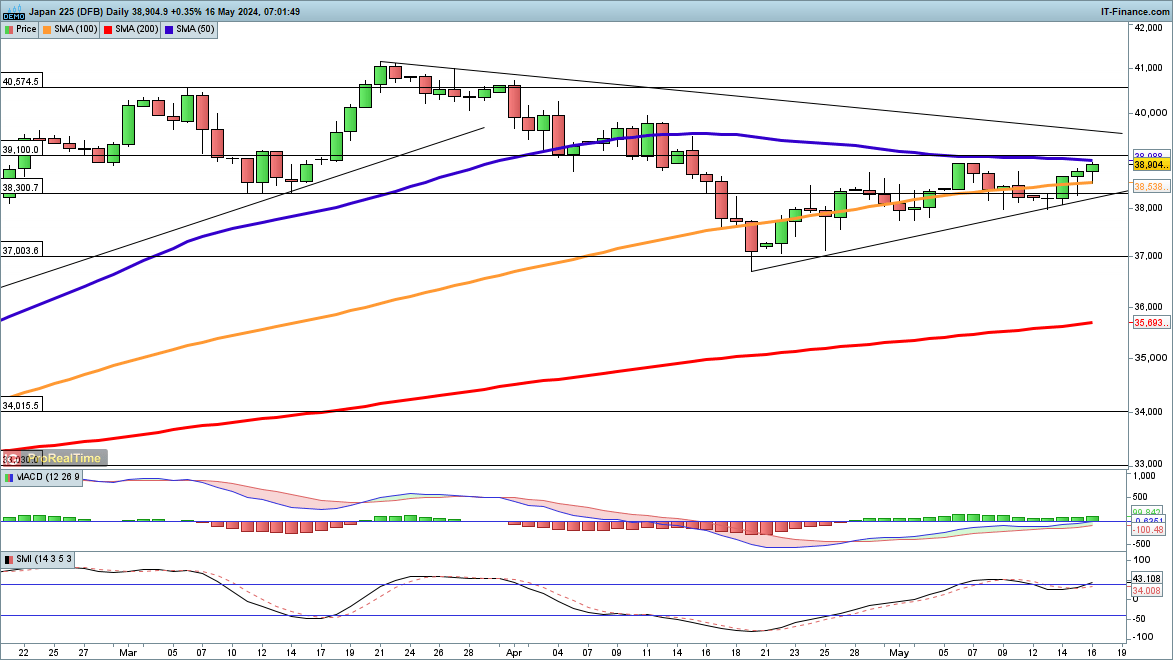

Nikkei 225 gains continue

Japanese shares also made headway despite a strengthening yen , and the Nikkei 225 finds itself at the 50-day simple moving average (SMA).

The steady rebound from the lows of April remains in place. A close above the 50-day SMA helps to support the bullish view. Further gains target trendline resistance form the late March record high, and then the area around 39,800, which marked the highs in early April.

A close below 38,300 would signal a break of trendline support from the mid-April lows.

Nikkei Daily Chart