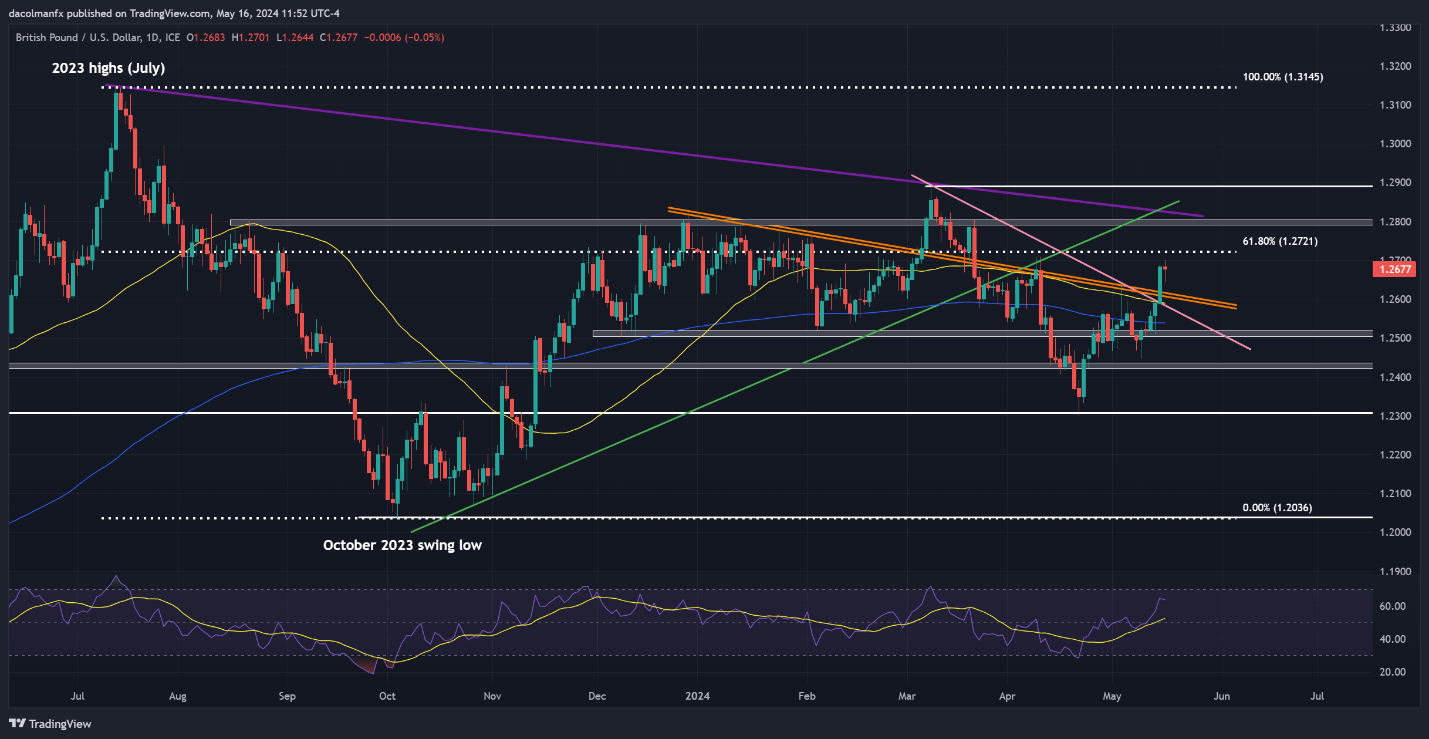

Wondering about EUR/USD

EUR/USD FORECAST - TECHNICAL ANALYSIS

EUR / USD was subdued on Thursday, failing to follow through to the upside after the previous session’s bullish breakout, with the exchange rate retreating modestly but holding steady above 1.0865. Bulls must ensure prices stay above this threshold to fend off potential seller resurgence; failure to do so could trigger a pullback toward 1.0810/1.0800.

On the flip side, if buying momentum resumes and the pair pivots upwards, overhead resistance may materialize near 1.0980, an important technical barrier defined by the March swing high. On further strength, buyers could be emboldened and initiate an attack on 1.1020 in short order, a dynamic trend line extended from the 2023 peak.

EUR/USD PRICE ACTION CHART

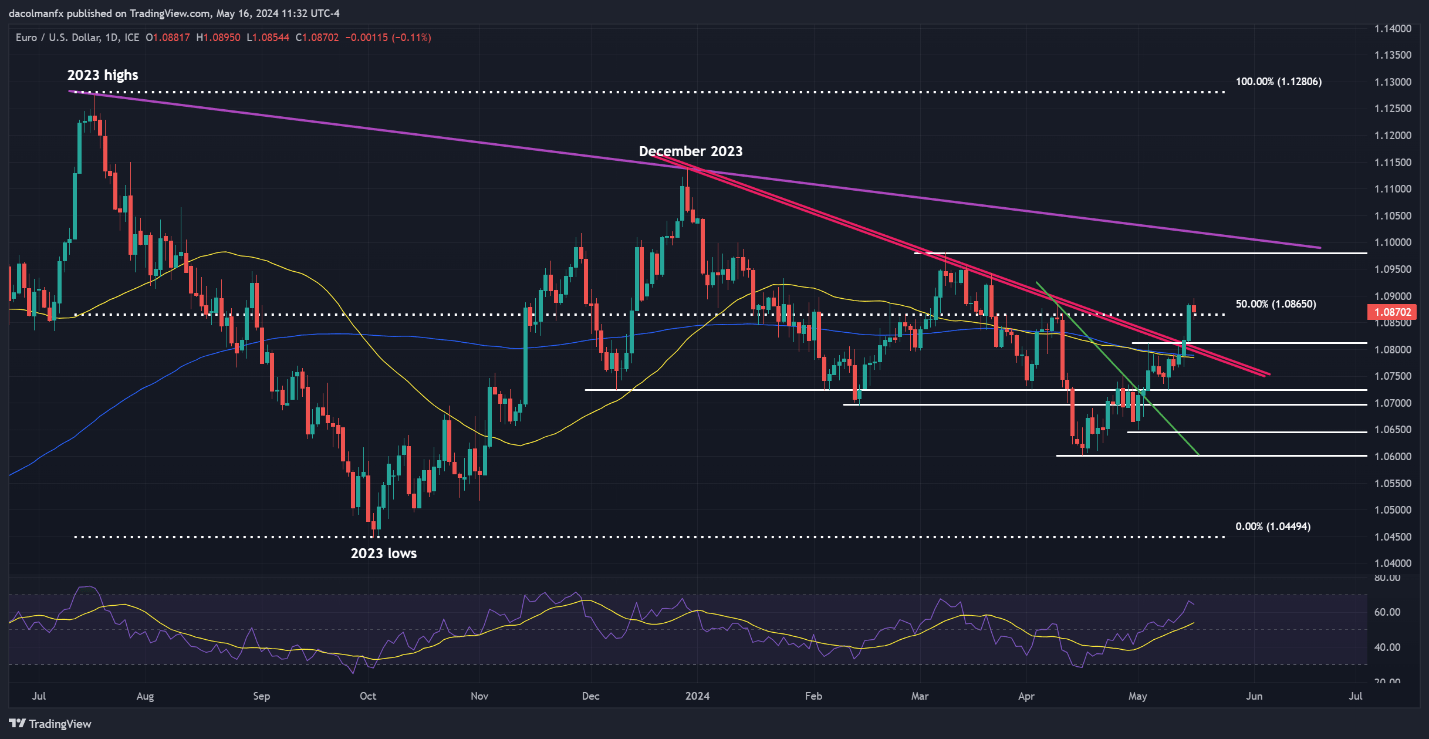

For an extensive analysis of the British pound

GBP/USD FORECAST - TECHNICAL ANALYSIS

GBP/USD ticked lower on Thursday following a robust performance earlier in the week, with buyers pausing for a breather to evaluate the outlook in the wake of the recent rally. If bullish momentum resumes, resistance awaits at 1.2720, marked by the 61.8% Fibonacci retracement of the 2023 sell-off. Beyond this, the 1.2800 handle could come into focus.

Conversely, if upward pressure fizzles out and leads to a meaningful bearish reversal, confluence support stretching from 1.2615 to 1.2590 could provide stability and prevent a deeper retrenchment. In the event of a breakdown, however, attention will shift towards the 200-day simple moving average, positioned around 1.2540. Further losses below this point could usher in a move towards 1.2515.

GBP/USD PRICE ACTION CHART