Euro (EUR/USD) Analysis and Charts

- EUR/USD takes back some of its earlier losses

- Fed Chair Powell’s comments offered the Dollar a little support

- Trade will likely be muted into Thursday’s US inflation numbers

The Euro made back just a little ground against the United States Dollar in Asia and Europe on Wednesday as investors weighed the previous day’s Congressional testimony from Federal Reserve Chair Jerome Powell and looked forward to his second session on Capitol Hill.

Arguably, he’s not told the markets anything they didn’t suspect (and hadn’t priced in) so far but the Dollar got a little boost from his comments, nonetheless.

Essentially Powell stuck with the idea that more data are needed to nail down an interest rate cut this year, but that, hopefully, prices are heading in the right direction. The markets’ central thesis that a rate increase is highly unlikely remains very much in place.

The broad expectation is that the Fed will have seen enough to begin carefully lowering US borrowing costs by September, as long as the inflation numbers permit it. But that expectation was in place before Powell spoke.

EUR/ USD is likely to trade pretty narrowly now, at least until Thursday when the markets will get a look at official US consumer price data, with a snapshot of German inflation also due.

Economists expect overall, annualized US inflation to have decelerated to 3.1% last month, from May’s 3.3% rate. The core print is expected to be stickier though, holding steady at 3.4% -still too high for the Fed, but trending down.

Germany’s ‘final’ June rate is expected to drop to 2.2% from 2.4%.

The Fed Chair second day of testimony is typically of less immediate market impact than the first, but investors may well sit on their hands until Mr Powell has finished speaking, just in case.

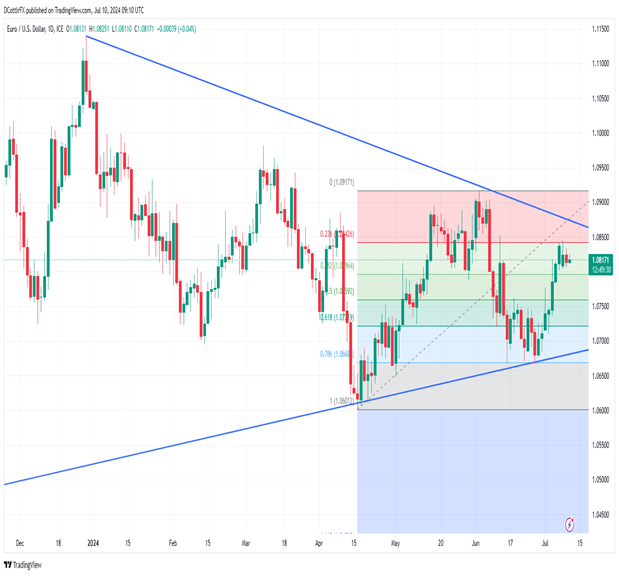

EUR/USD Technical Analysis

The Euro remains court between medium-term up- and downtrend lines as its trading range narrows. The retracement level of 1.08426 continues to elude the bulls who have repeatedly tried and failed to get a daily close above that level in recent sessions.

Near-term forays higher will probably attract suspicion unless this level can be durably topped, and that doesn’t look very likely although.

Reversals find support around 1.08 ahead of the next retracement at 1.07964. The broad range between 1.0850 and 1.06488 seems very likely to bound the market, at least through the northern hemisphere summer trading period when volatility traditionally eases off at least a little.

EUR/USD now trades very close to its 200-day moving average which comes in just a little below the current market at 1.07994.