French Election to Weigh on the Euro until The Fed Prepares for a US Rate Cut

EUR/USD has exhibited a broad, choppy downtrend for 2024, moving back and forth in a reactive fashion as rate cut projections were clawed back significantly in the US and to a lesser degree for the ECB, hence the pair favouring the downside. In Q3, the euro may recover to some degree but remains fraught with uncertainty as French election concerns and Fed easing policy collide. Overall, the Fed story is expected to dominate even if the euro fails to exhibit broad strength when compared to G7 currencies.

As Q2 draws to a close, prices attempt to regain ground lost after the unexpectedly strong May NFP report and the Fed's hawkish inflation revisions in their June economic projections weakened the pair.

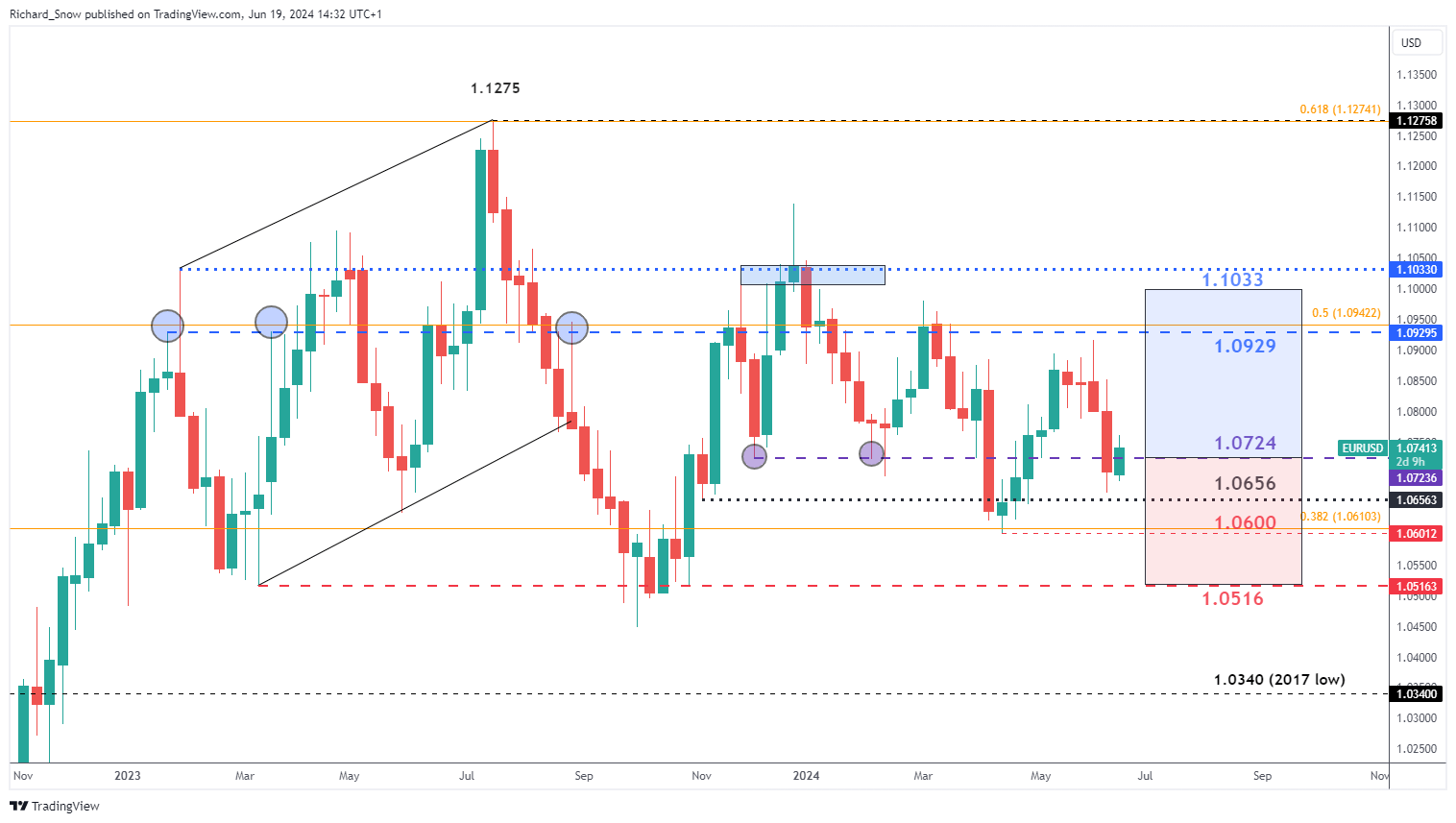

At the time of writing, the weekly chart shows Q2 closing around 0.0724, a level that provided support in late 2022 and February 2023. A significant upward move from here would be challenging and would likely require improved US conditions that more clearly indicate a potential September rate cut.

For EUR/ USD , a key resistance level lies just below the psychological 1.1000 mark, at 1.0929 – a point that repeatedly blocked advances in 2023. In extreme scenarios, 1.1033 could come into play, having capped weekly gains more recently. On the downside, 1.0600 is crucial if periphery bond spreads widen dramatically, with 1.0516 potentially becoming relevant thereafter.

EUR/USD Weekly Chart

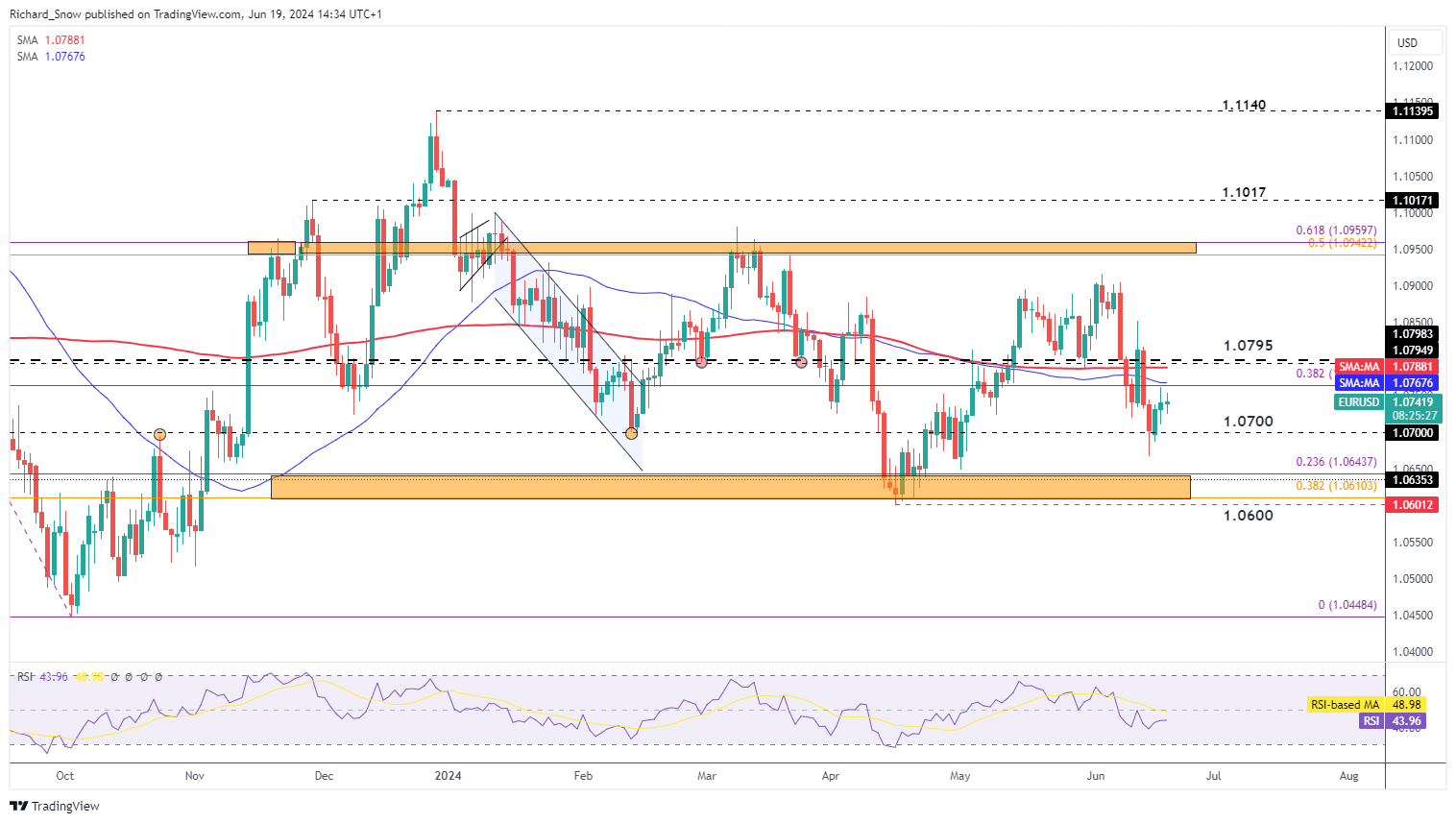

The daily chart provides a more granular look at the pair which has tended to trade within a broad range for the majority of the year. Given the many moving parts surrounding the euro’s value, signals of an obvious directional move appear to be absent, apart from the negative divergence that has been playing out since the early June swing high.

The bearish price action was held up at 1.0700 and has headed higher since. The most immediate levels to surpass include the 200-day simple moving average (SMA) and the 1.0795/1.0800 zone. A third potential target level/zone appears at channel resistance with a midpoint at 1.0950. Downside levels which will come into play very quickly if uncertainty in France ticks up a few notches, include 1.0600 and 1.0516 in an extreme case as mentioned above.

EUR/USD Daily Chart

BoE Appears Closer to a Rate Cut, EUR/GBP to Resist Further Sell-off

The Bank of England (BoE) may have lowered the bar for a rate cut, potentially as soon as August, highlighting the Bank’s updated forecast that is due at the same time. The Bank prefers to alter interest rates around the quarterly updates as they are equipped with the best possible information at the time. Stagnant growth in April despite a slight uplift in Q1 GDP and CPI hitting the 2% target have not been sufficient to convince the majority of officials to join those calling for a lowering of interest rates. Nevertheless, it appears just a matter of time before the committee lowers rates which could weigh on the pound at a time when EU inflation (May) lifted higher something that could support the euro if subsequent data fails to soften.

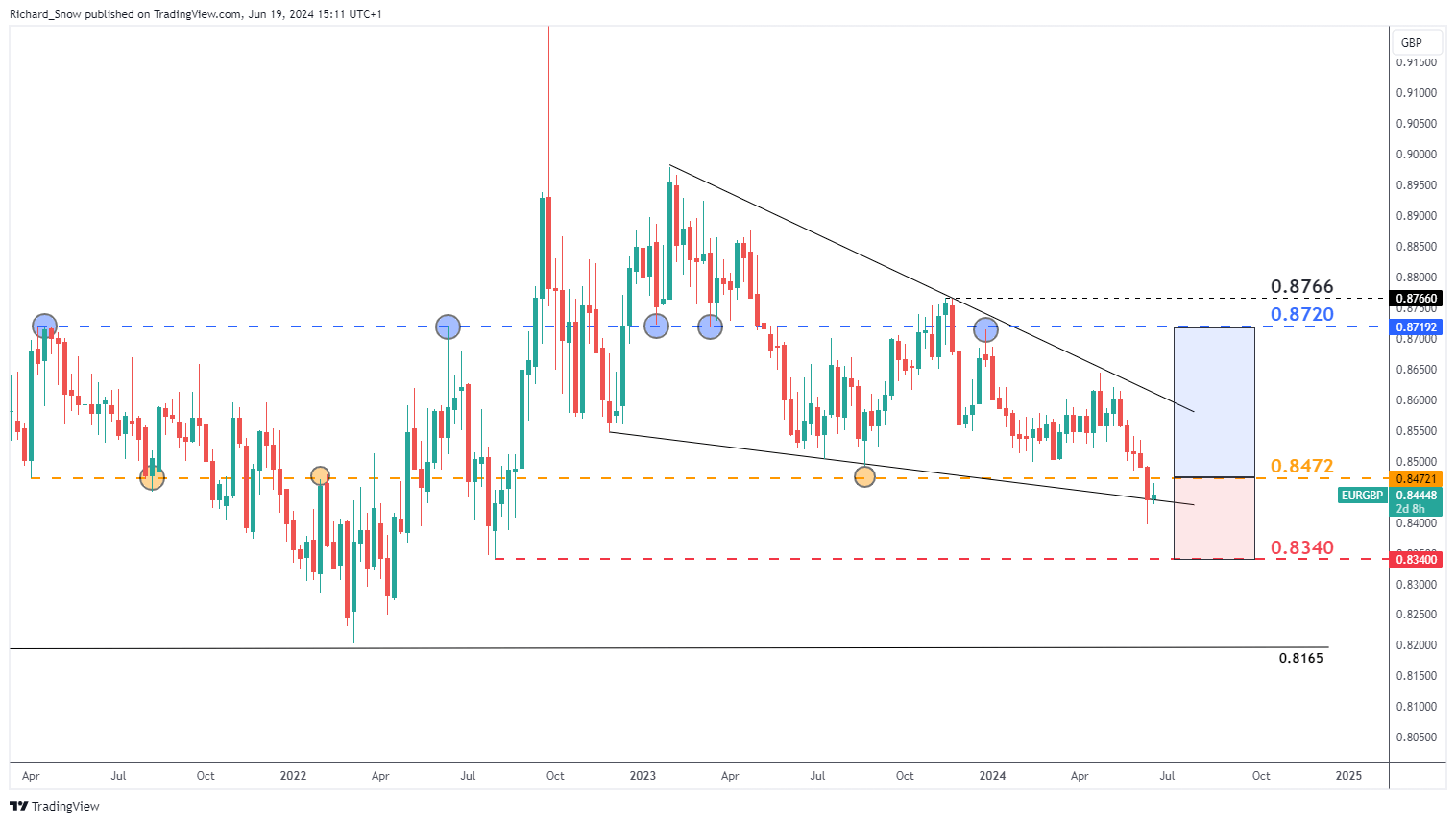

The pair rounds up Q2 within a broad descending wedge, which is typically a bullish reversal pattern. 0.8472 is likely to come into play early on in Q3 but the real test will be an attempt to trade back towards the descending trendline which constitutes the upper bound of the pattern. Thereafter, 0.8720 – a major pivot point since 2021 – comes into focus.

On the downside, if the prospect of a new right-wing government were to emerge as a real possibility, the euro could continue to sell-off early into the new quarter where 0.8340 would be the level of interest. Essentially, over the forecast horizon EUR/GBP is anticipated to recover but allows for move lower at the very start of Q3.

EUR/GBP Weekly Chart