Nvidia (NVDA) Technical Outlook

- Nvidia back below $3 trillion market capitalization.

- A technical chart gap may be a sign of further losses to come.

Nvidia has shed nearly 16% of its market value in the last three trading sessions as sellers take control of the world’s largest chipmaker. Nvidia became the world’s largest company last week, with a valuation in excess of $3.34 trillion, surpassing both Microsoft and Apple, but now sits in third place with a market cap of around $2.85 trillion. The recent sell-off coincides with news that Nvidia CEO Jensen Hang has sold around $95 million of stock in the past few days. To keep the recent consolidation in perspective, Nvidia remains on of the S&P 500 ’s top performers, with year-to-date gains of around 140%.

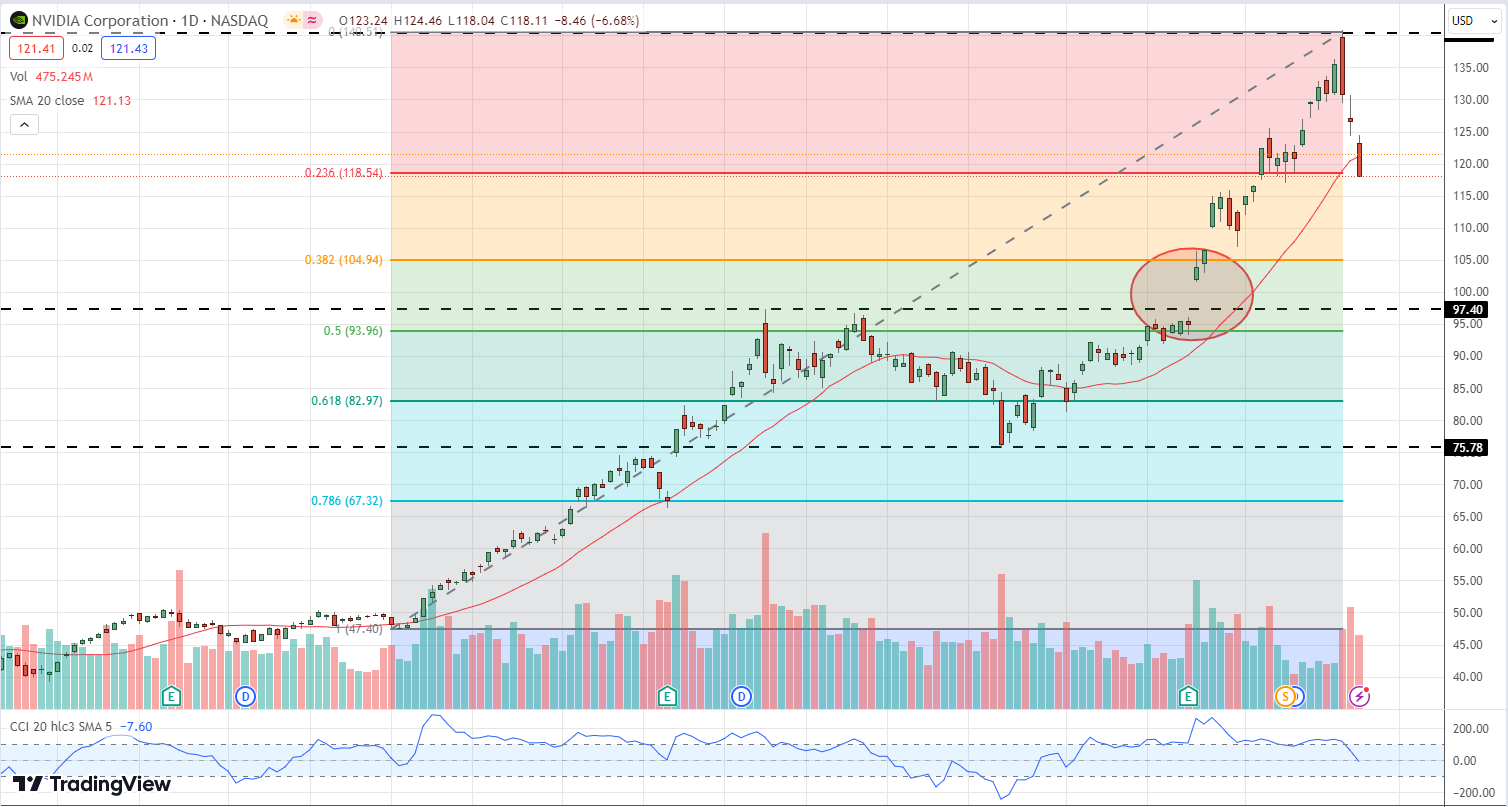

There is a ‘gap’ on the daily Nvidia chart, formed when the last company earnings were released, and this may come into play if the recent bearishness continues. Nvidia is currently testing the 23.6% Fibonacci retracement of this year’s rally and if this fails then a move lower to the 38.2% retracement level of around $105 may be seen. Below here is a gap in the chart between the May 22nd high at $96 and the May 23rd low at $101.50, made on the last earnings release. The 20-day simple moving average, a recently supportive dynamic indicator, is also being tested. This runaway gap may attract traders, especially with the increased selling volume seen in the last three days.

Trading the Gap – What are Gaps & How to Trade Them?

Nvidia Daily Price Chart

What’s your view on Nvidia? You can let us know via the form at the end of this piece or contact the author via Twitter .