Gold (XAU/USD) & Silver (XAG/USD) Sentiment Analysis and Charts

- Gold : Traders Lean Bullish Despite Potential Price Decline

- Silver : Retail Sentiment Signals Potential Price Decline

| Change in | Longs | Shorts | OI |

| Daily | 1% | -3% | -1% |

| Weekly | 2% | -8% | -2% |

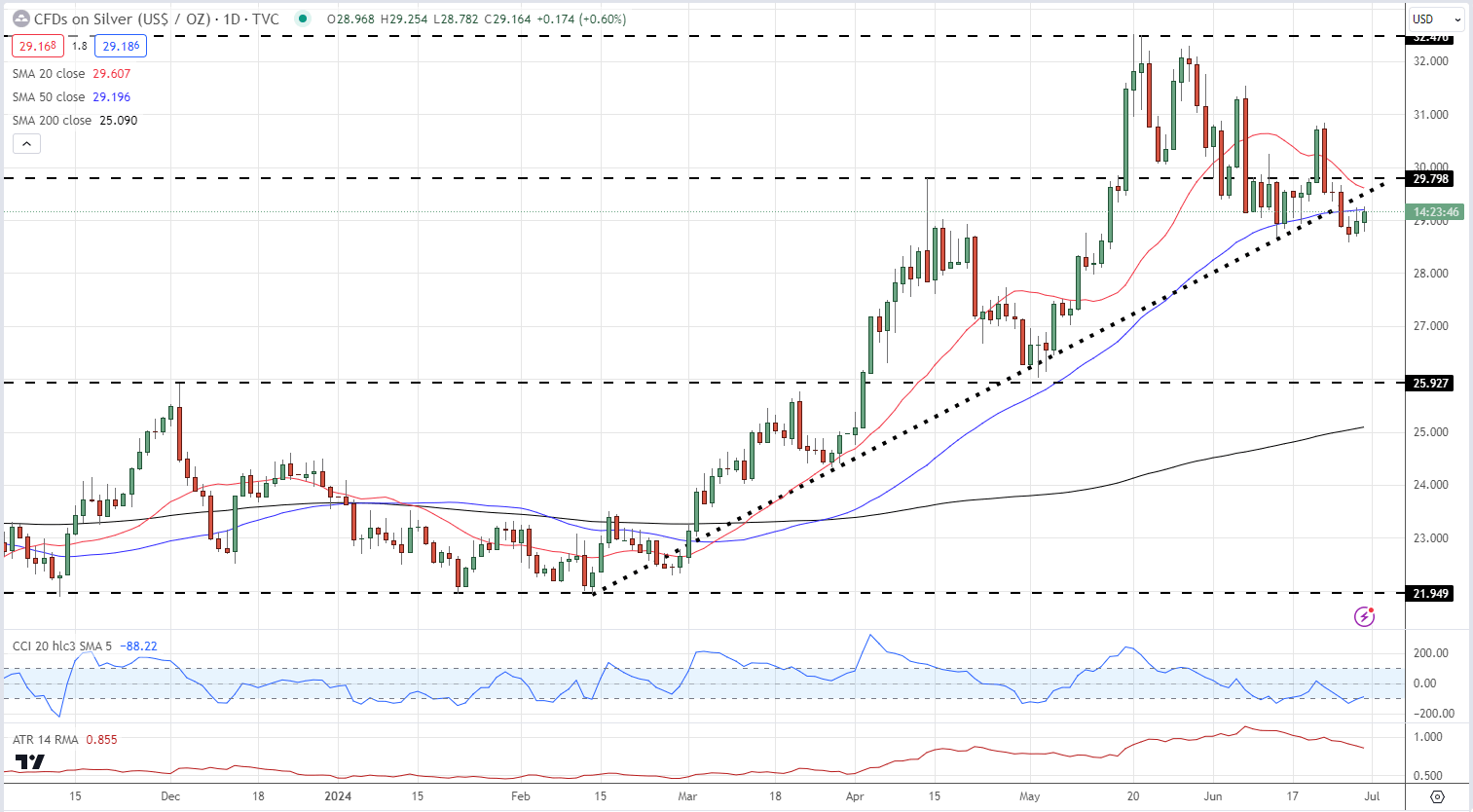

Gold (XAU/USD) Trading Outlook: Conflicting Signals as Retail Sentiment Shifts

The latest IG retail trader data presents a nuanced picture for gold trading. With 57.34% of traders holding net-long positions and a long-to-short ratio of 1.34 to 1, the market appears bullish. However, our contrarian approach to crowd sentiment indicates potential downward pressure on gold prices .

Recent shifts in trader positioning add complexity to the outlook. Net-long positions have dropped 17.44% since yesterday but increased 3.80% over the past week. Conversely, net-short positions have surged 19.70% daily while declining 2.78% weekly. These conflicting trends contribute to a mixed trading bias for gold.

Gold Daily Price Chart

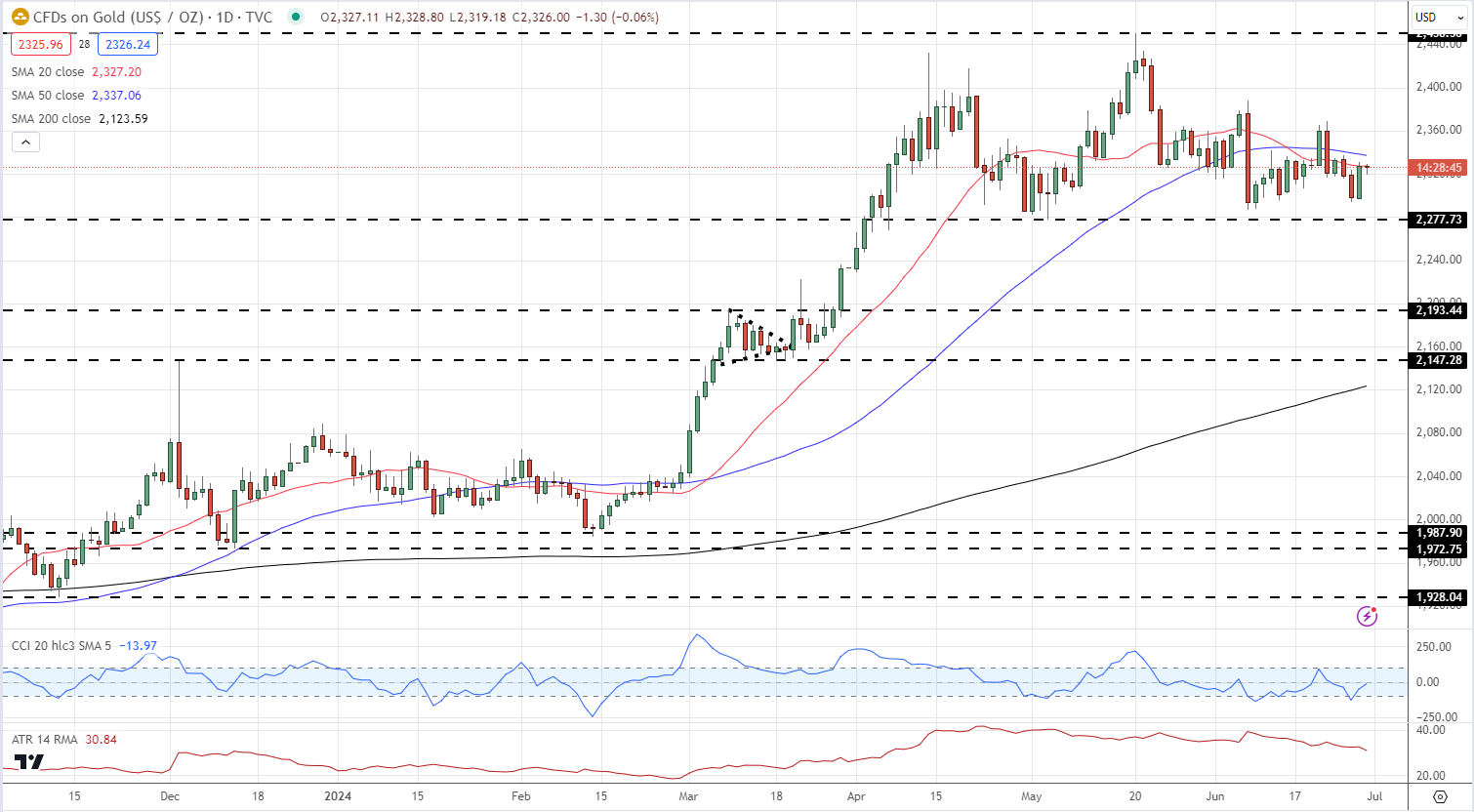

Silver (XAG/USD) Latest: Retail Sentiment Reaches Extreme Levels

Current retail trader data reveals an exceptionally bullish stance on silver, with 85.36% of traders net-long and a striking 5.83 to 1 long-to-short ratio. However, this extreme sentiment may paradoxically suggest a potential decline in silver prices, as our analysis typically counters crowd positioning.

The bullish bias has intensified recently, with net-long traders increasing by 1.69% daily and 9.86% weekly. Meanwhile, net-short traders have decreased by 11.76% since yesterday and 24.81% over the week. These trends contribute to a strengthened silver-bearish contrarian trading bias, highlighting the importance of careful market analysis.

Silver Daily Price Chart