British Pound (GBP) – Bank of England and Inflation Data on Deck Next Week

GBP/USD Analysis and Charts

- UK inflation is set to fall further.

- Will the Bank of England give the markets some guidance?

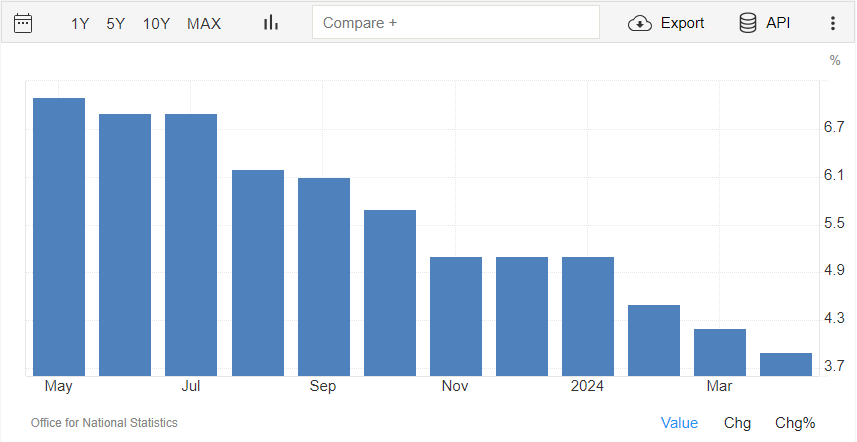

UK inflation is set to fall further, data out next week is expected to show, with core CPI y/y seen tumbling from 3.9% to 3.5%, while headline CPI y/y is seen dropping from 2.3% to 2.0%. UK inflation has been moving steadily lower over the last year and is seen hitting the BoE’s target rate (2%) in the coming months.

Core UK CPI y/y

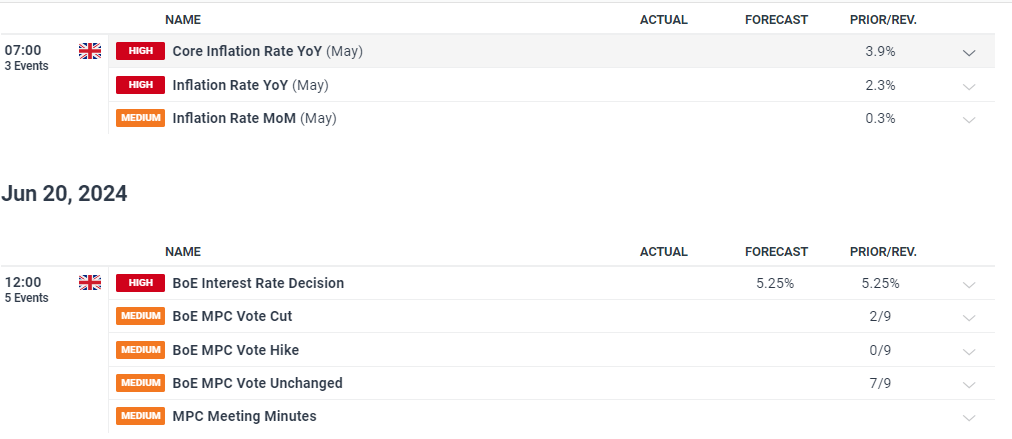

The inflation data, released one day before the latest Bank of England monetary policy decision, could lead the UK central bank to take a slightly more dovish stance if market forecasts are met. The Bank of England is seen cutting rates at the September meeting, with one more 25bp cut expected at the end of the year. While this is unlikely to change, the central bank may be able to give a more dovish forecast if the inflation is in line or better.

On Friday, the latest S&P Global UK PMIs are released for June, and while these are important, the inflation data and the BoE meeting will be the driver of Sterling going forward.

For all market-moving economic data and events, see the Monarch Capital Institute

UK Gilt yields have been lower since the end of May with the rate-sensitive UK 2-year now offered at 4.18%, around 40 basis points lower than May 30th. A dovish BoE could see these yields fall furthe r.

UK 2-Year Gilt Yield

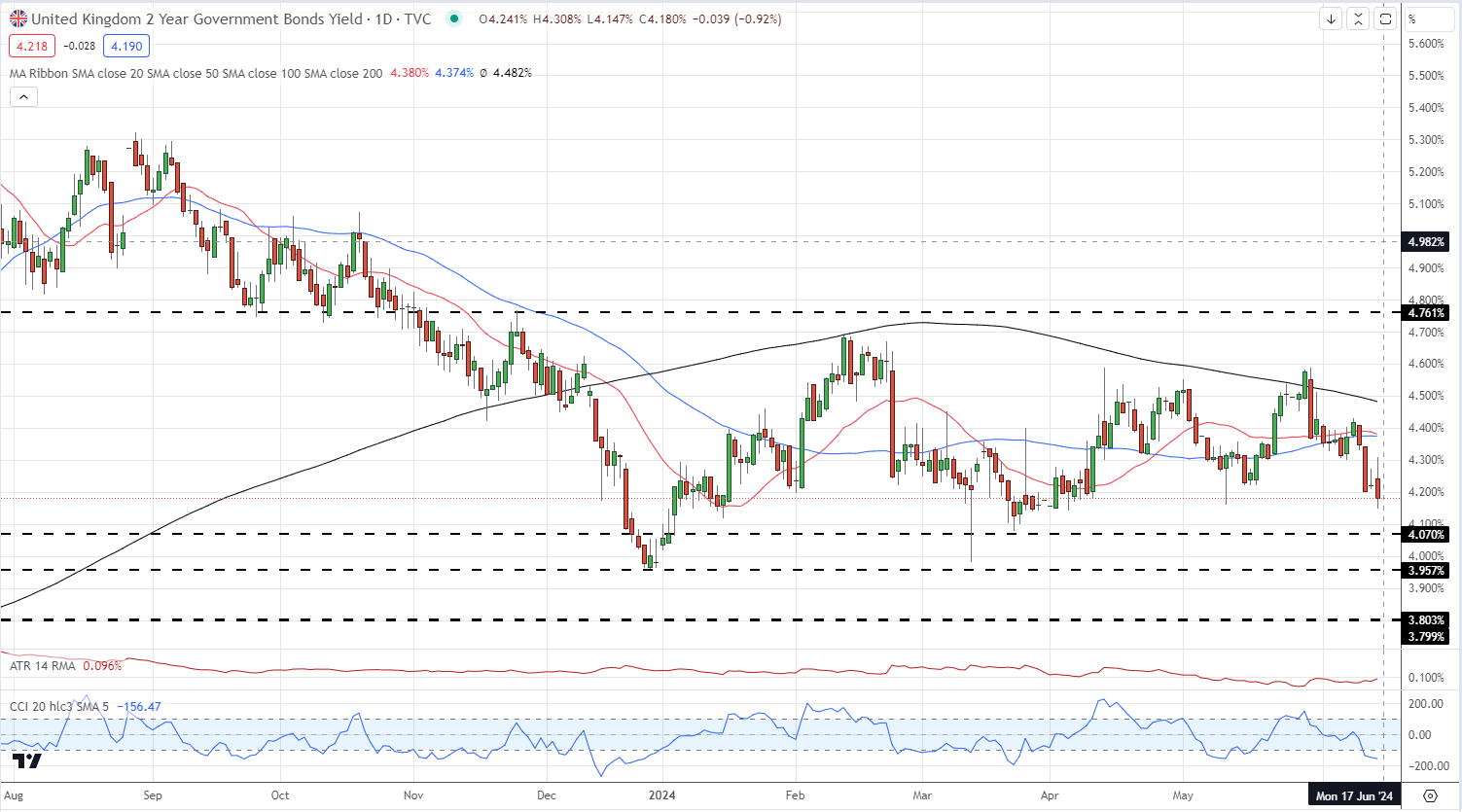

Cable is currently testing support as the dollar continues to push higher. The dollar is being helped by a fresh bout of Euro weakness, while the Japanese Yen is also slipping lower after last night’s Bank of Japan meeting. GBP/ USD is testing 1.2667 and a confirmed break below here would bring the 38.2% Fibonacci retracement level at 1.2626 into focus. Below here, 1.2550 comes into play.

GBP/USD Daily Price Chart

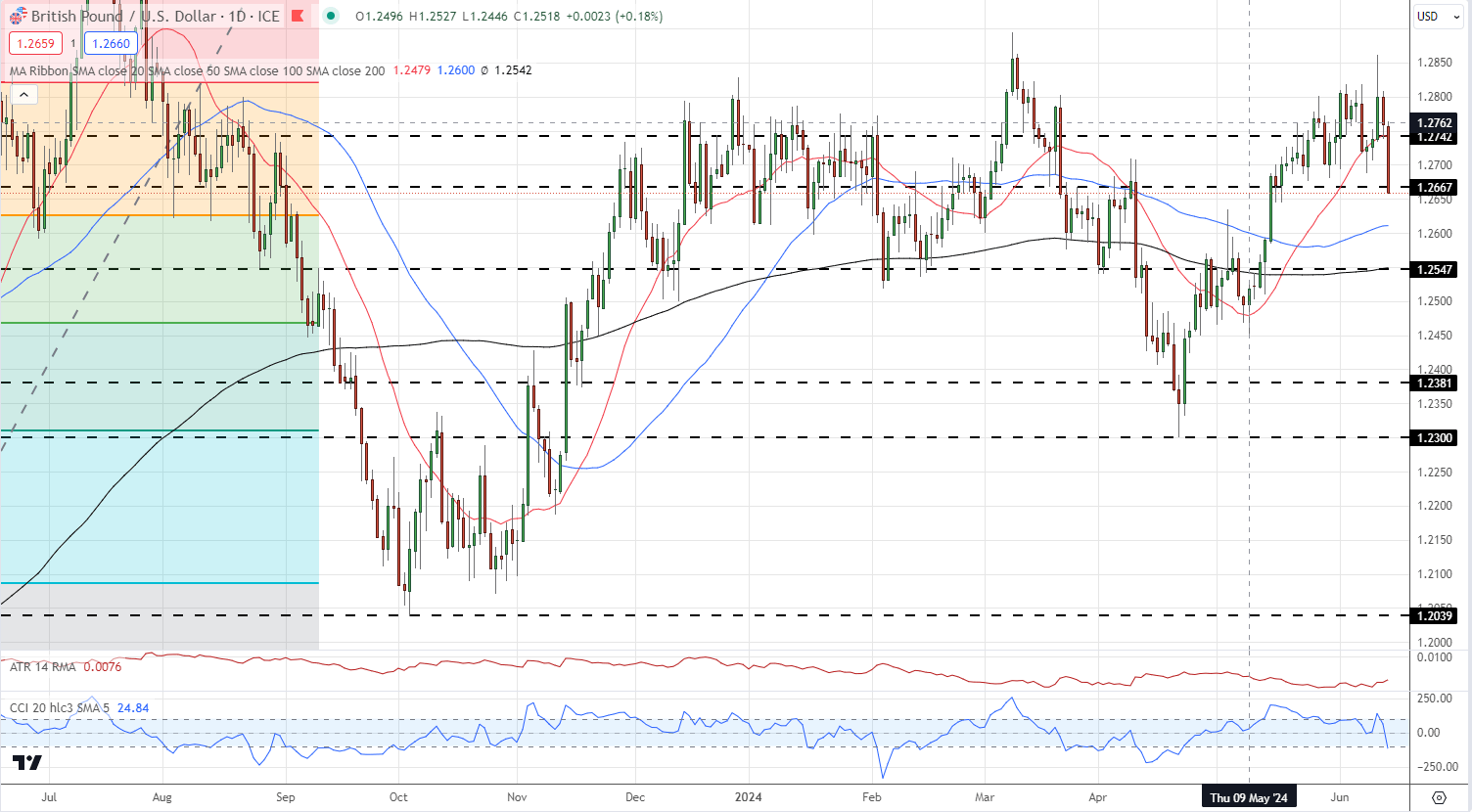

Retail trader data shows 48.81% of traders are net-long with the ratio of traders short to long at 1.05 to 1.The number of traders net-long is 23.96% higher than yesterday and 20.47% higher from last week, while the number of traders net-short is 23.69% lower than yesterday and 30.43% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current GBP/USD price trend may soon reverse lower despite the fact traders remain net-short.

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |