Aussie Dollar (AUD/USD, AUD/NZD) Analysis

- Geopolitical tensions cool, allowing AUD limited room to recover

- AUD/USD shows signs of recovery but technical headwinds remain

- AUD/NZD bull flag emerges as the pair recovers from overbought territory

- Elevate your trading skills and gain a competitive edge. Get your hands on the Aussie dollar Q2 outlook today for exclusive insights into key market catalysts that should be on every trader's radar:

Geopolitical Tensions Cool, Allowing AUD Limited Room to Recover

In the early hours of Monday morning, the risk-aligned Australian Dollar attempted to claw back losses that developed early on Friday after reports of an Israeli strike in Iran. The tit-for-tat conflict appears to be over now that Iranian officials stand by their view that Israel has already received its response.

Before the relative calm, FX markets revealed a preference for safe haven currencies , something that has revealed a full reverse in the early hours of trading on Monday. As a result the Australian dollar has perked up against the US dollar and attempts to build on Friday’s gain against the Kiwi dollar.

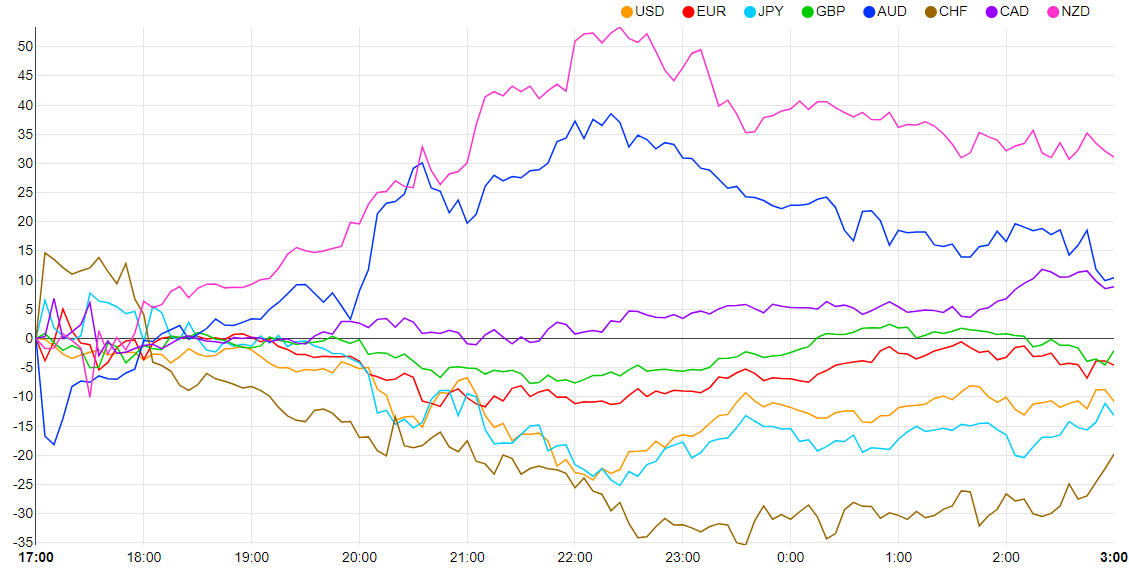

Major Currency Performance Overnight (Eastern Standard Time)

A calmer geopolitical backdrop may allow limited room for an AUD recovery but US GDP and PCE data on Thursday and Friday, respectively, could weigh on risk assets towards the end of the week. Robust growth, jobs and inflation data led to a hawkish repricing in the Fed funds rate which may gain momentum if we see further surprises in the data later this week – supporting USD .

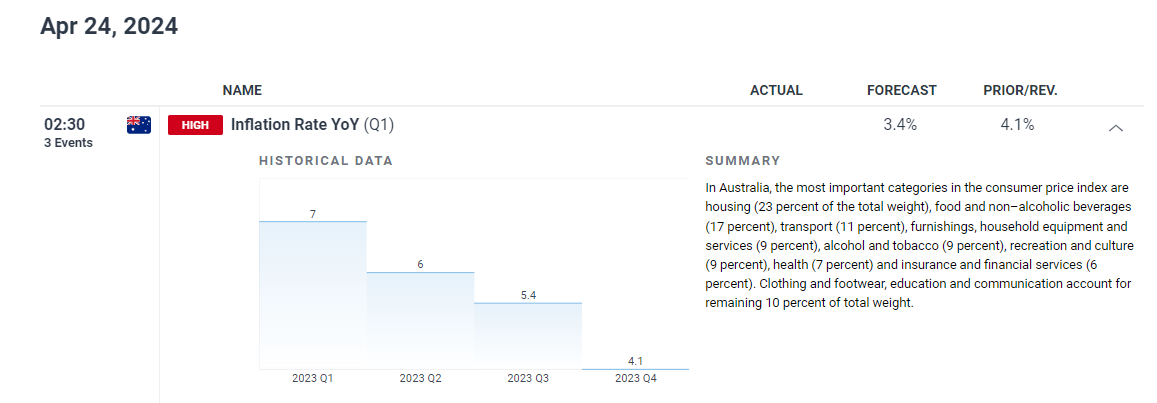

On Wednesday, Australian inflation data for Q1 is expected to reveal another decline, from 4.1% to 3.4% which may leave AUD vulnerable ahead of the high impact US data.

Monarch Capital Institute

AUD/USD Shows Signs of Recovery but Technical Headwinds Remain

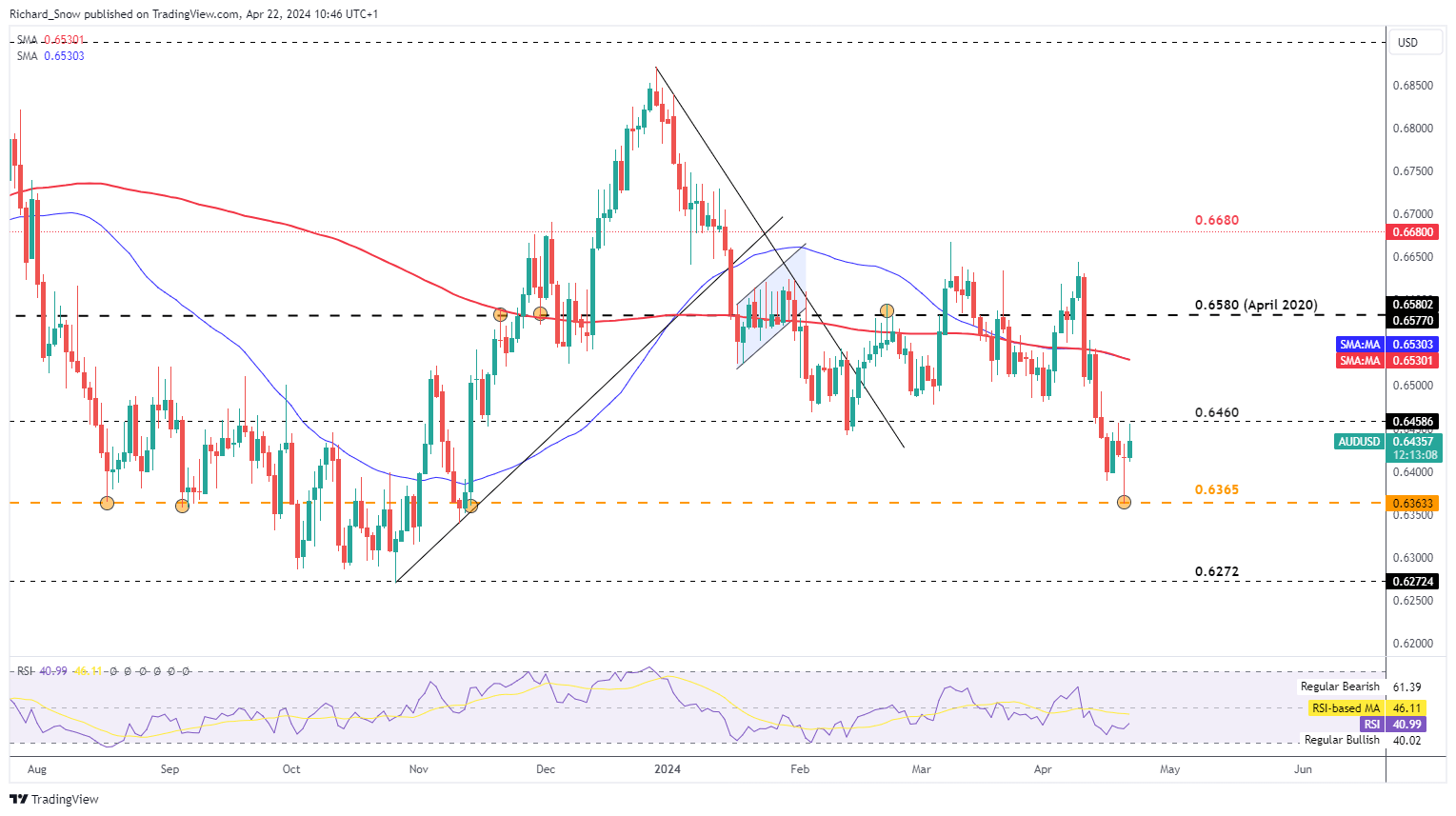

The sharp rejection at 0.6365 provides the basis for today’s shorter-term recovery, now that the immediate threat of continued Israeli-Iran conflict has dissipated, and it would appear neither side are motivated to continue the direct exchanges.

The improved risk sentiment buoys the Aussie dollar for now, with 0.6460 the immediate level of resistance standing in the way of a further charge towards the 200-day simple moving average (SMA), currently around 0.6530.

Longer-term AUD/USD upside potential appears in doubt after comments from Fed Deputy Governor John Williams explicitly put rate hikes on the table, should data necessitate such a response. Implied probabilities derived from Fed funds futures reveals that the market is growing less confident around multiple Fed rate cuts this year; and with the central bank unlikely to alter rates around the election, the window for additional cuts is closing.

AUD/USD Daily Chart

AUD/NZD Bull Flag Emerges as the Pair Recovers from Overbought Territory

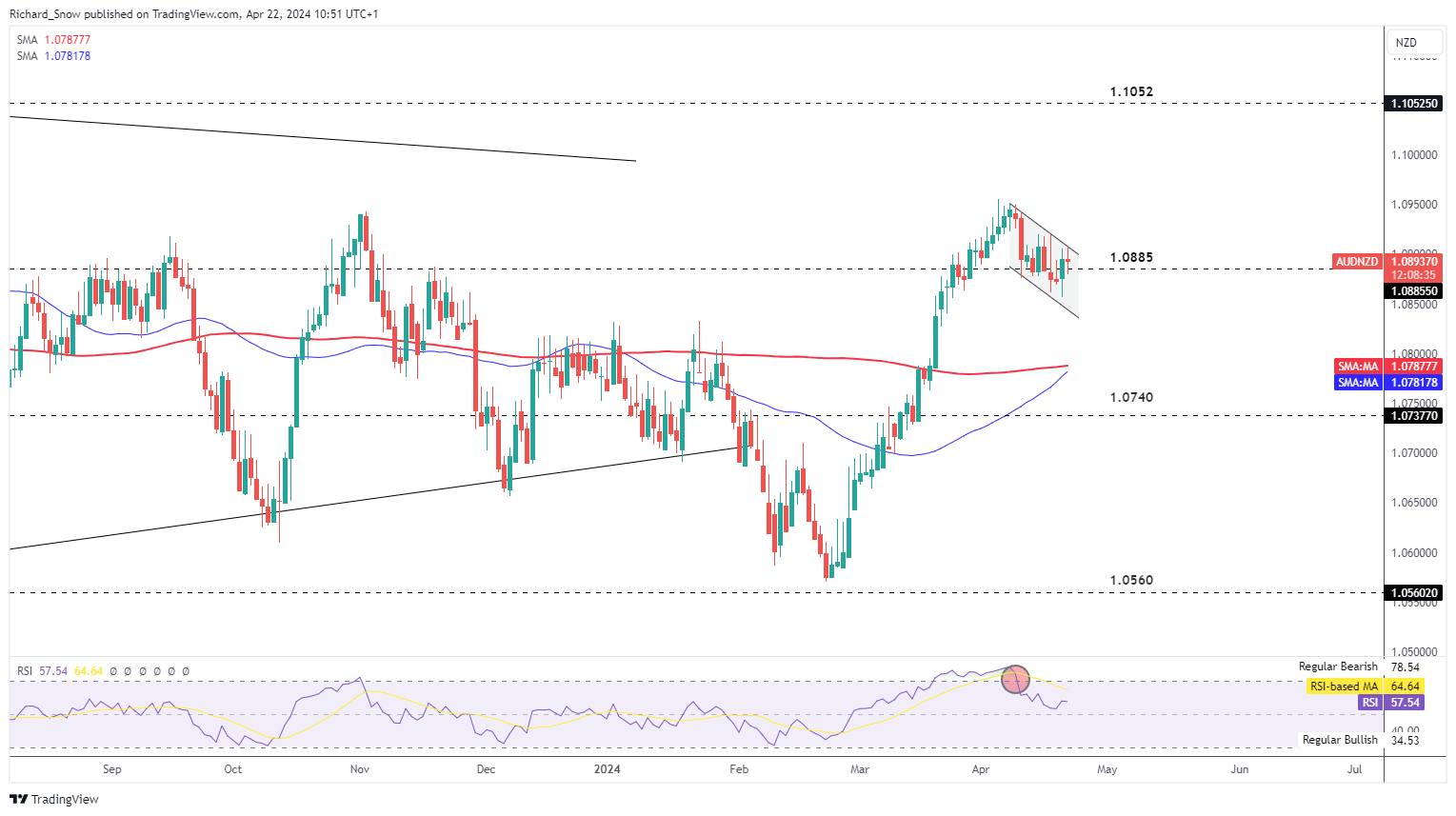

AUD/ NZD has consolidated lower in the month of April after the massive bull run, which gathered pace in late February. In early trading on Monday, price action is fairly flat, attempting to test the upper bound of the downward sloping channel. The channel functions as a potential bull flag for a bullish continuation, potentially.

The bullish bias remains constructive as long as prices remain above 1.0885 – the early November 2022 swing low which has capped previous advances. The 50 and 200-day simple moving averages converge, opening up the possibility of a bullish crossover – a typically bullish signal. One criticism of the moving average crossover is it regarded as a lagging indicator and can simply exist as confirmation of what has already transpired.

A cluster of prior highs around 1.0833 coincides with the bottom of the bull flag and represents the area of interest for AUD/NZD bears should the market trade lower from here.

AUD/NZD Daily Chart

Stay informed about breaking news and themes driving the market by subscribing to our weekly newsletter