Article written by IG Market Analyst Hebe Chen

Microsoft earnings date

Microsoft Corporation ( Nasdaq : MSFT) is scheduled to reveal earnings on April 25, 2024, after the market closes. The earnings report will cover the fiscal calendar quarter ending March 2024, which aligns with FY24 Q3 for Microsoft.

Microsoft earnings expectations and key watches

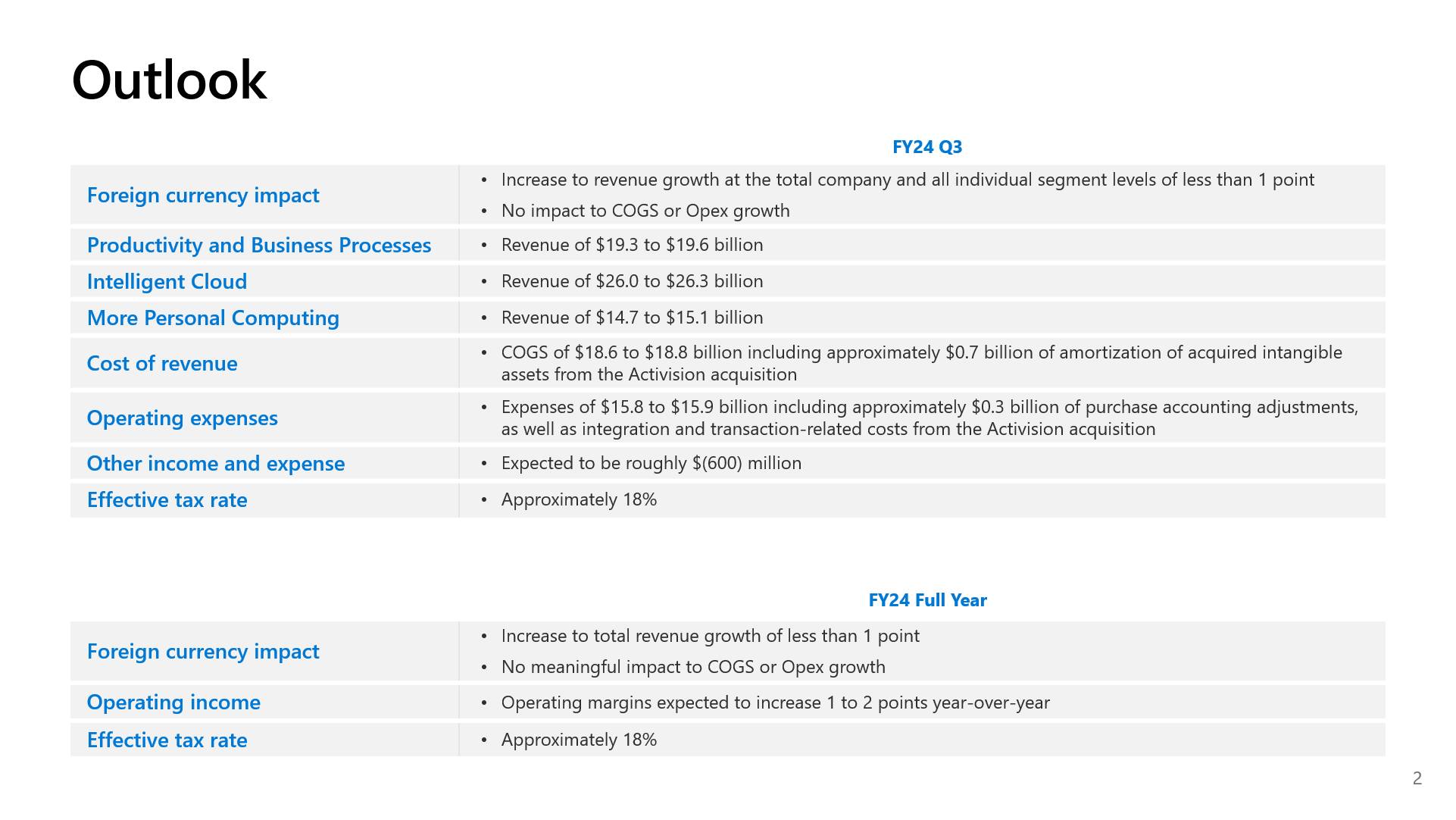

Based on the Q3 guidelines published alongside the Q2 report, a slower revenue growth compared to previous quarters is expected. Q3 revenue is anticipated to be around $60.86 billion, down from $61.13 billion in Q2, while still representing approximately 19% year-over-year growth. Earnings per share are estimated to be $2.84, an increase from $2.77 last quarter, marking a 27% year-over-year improvement.

Intelligent Cloud

As demonstrated in Microsoft's recent reports, cloud services remain the crown jewel, driving “Intelligent Cloud” revenue to $25.88 billion in Q2, up 20% year-over-year, and contributing to more than 40% of the group's total revenue. This momentum is expected to continue in Q3 as Microsoft projects revenue from this segment to grow to $26-$26.3 billion.

AI

While Microsoft's cloud segment shines as its crown jewel, the most anticipated excitement will more likely come from its AI update. As the world’s most valuable company, Microsoft’s progress in its AI development will be under strict scrutiny.

Since investing heavily in OpenAI to secure the enviable partnership, Microsoft has prioritised the integration of AI into its tech ecosystem. Today, with ChatGPT becoming a household name, bullish investors are eagerly anticipating Microsoft's progress in AI integration into and next strategic moves to capitalize on its leadership in the AI space.

Challenges

The notable laggard within Microsoft’s technology powerhouse comes from its devices and Office commercial products revenue, which recorded 9% and 17% decrease in the previous quarter. Given the subdued demand from the PC market, these two sectors are expected to see a low double-digit decline in Q3.

Microsoft stock price

The prevailing risk-averse sentiment since the beginning of Q2 has effectively frozen the ascending journey for Microsoft's stock prices , which surged by 38% from October 23 to March 2024; by the time of writing, the tech giant's share prices have fallen more than 6% from its all-time high of $427.

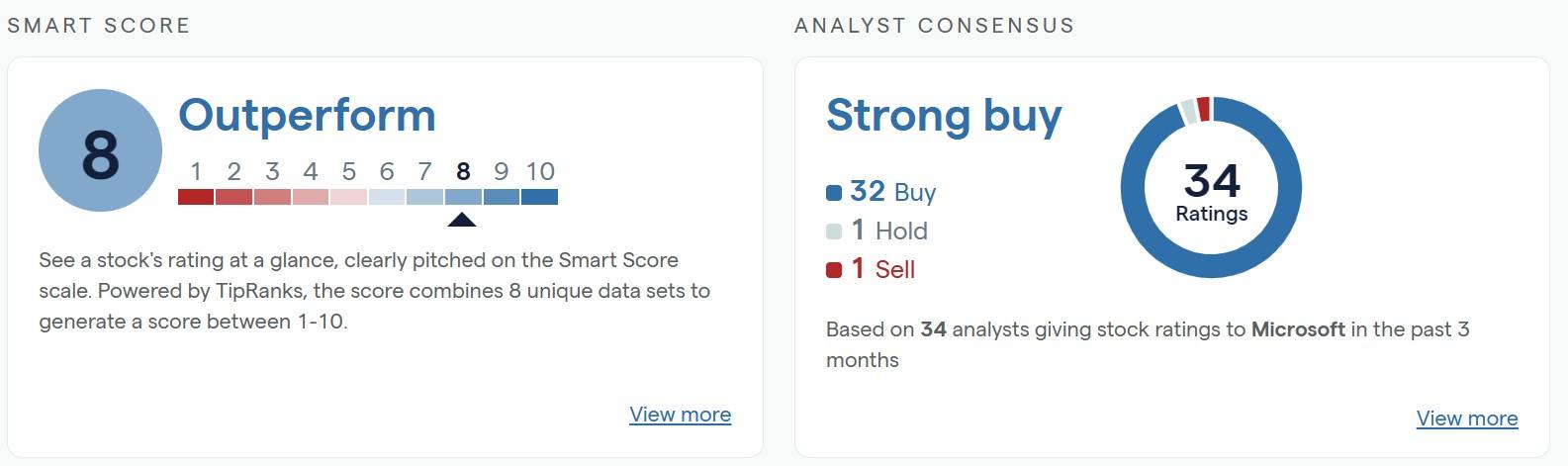

Despite the recent pullback, TipRanks gives MSFT a 'outperform' smart score, meanwhile, 32 out of 34 analysts have recommended a buy in the past 3 months.

Looking at the daily chart, the price has experienced two vital breakouts to signal further downtrend could be in the cards, including: breaching the months-long ascending trendline and breaking below the 100-day moving average for the first time in 2024. Furthermore, the RSI has also fallen to its lowest level since November, underscoring the bearish momentum at the moment.

Technically, any further downtrend will find imminent support at the $379-$382 zone, where the 23.6% Fibonacci retracement and the previous high converge. A break below this support could open the door to challenge the critical 200-day SMA, unbroken for over a year. On the other hand, the first upside target could be eyed at $415, where the 50-day SMA sits.

Risk warning:

The figures stated are as of 23 April 2024. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.