Japanese Yen (USD/JPY) Analysis and Charts

- USD/JPY inches up in a market fixated on what the Fed will have to say

- This week’s roller-coaster ride has calmed down

- However, the Yen remains under pressure

The Japanese Yen was lower again against the United States Dollar on Wednesday after what’s already been a wild ride for the currency this week.

If, as looks increasingly likely, Japan’s Ministry of Finance intervened in the foreign exchange market on Monday to counter Yen weakness, it hasn’t bought a lot of respite. Although Tokyo has not so far confirmed or denied any action, wire reports based on money market data suggest that as much as $35 billion could have been spent to prop the Yen up.

Various important speakers had previously suggested that the Dollar’s sharp rise against the local unit has been too fast and at odds with market fundamentals. But with expectations of when US interest rates might fall pushed further and further back, the Yen’s ultra-low yields are simply not tempting. They’re unlikely to be for some time to come, too, even as the Bank of Japan has suggested that rates could rise much further in response to a durable rise in inflation .

For now, of course, all this matters less than what the Federal Reserve will do later on Wednesday’s global session. The US central bank is not expected to do anything to borrowing costs this time around, but the extent to which it confirms market expectations that rates could still fall around the end of the third quarter will be key.

The US economy remains perhaps surprisingly resilient. So the chance that rate cuts will be pushed yet further out is certainly still in play. If seen, this would only support the Dollar further and provide further headaches for the Japanese authorities.

USD /JPY Technical Analysis

Learn how to trade USD/JPY with our expert guide

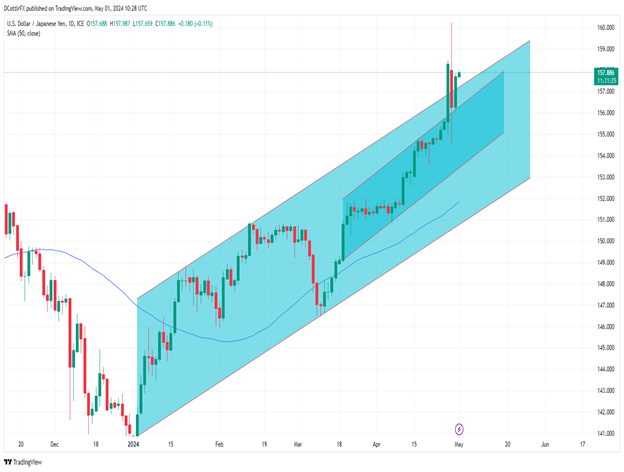

The uptrend in place since the start of this remains dominant and, even despite Monday’s huge falls, USD/JPY is still above the upper boundary of its channel.

Unsurprisingly, however, the market is starting to look overbought and perhaps a little short of momentum now, and it would not be a surprise to see the rate retreat into that band. It now offers support at 157.26.

USD/JPY has moved far above its 50-, 100 and 200-day moving averages and, on that basis alone, some consolidation is probable.

Naturally traders will now be on watch for any signs that the Tokyo authorities are stepping in whenever the market gets up toward 160.00. However, while suspicions of that might stop sudden upside spikes, it seems unlikely to stop this bullish market getting there in due course anyway.

Reversals back into the former trading band could find support at 156.1. That’s the top of a narrower, better-respected, and possibly more meaningful uptrend. It’s also very close to where the market ended up at the end of Monday’s wild ride.

-By David Cottle for